This isn't true except in very limited circumstances. Here's what happens:

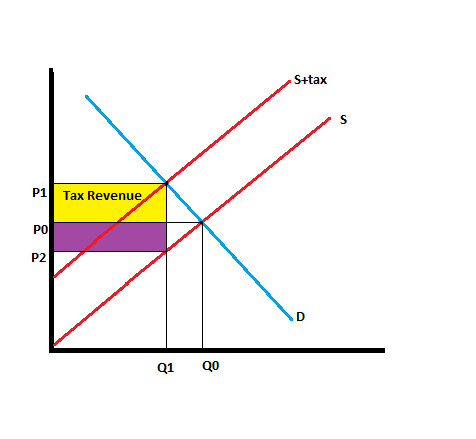

in this chart the yellow portion is borne by consumers (they are paying p1), the purple portion is borne by producers (they are receiving p2), and the triangle to the right is the dead weight loss from sales that weren't made.

There's no may about it. Quantity demanded is reduced except, again, in very limited circumstances.

Why, might you ask, are those circumstances limited? That's because if an increase in price (either due to supplier choice of the imposition of a tax) didn't reduce the quantity demanded, the supplier absolutely wasn't pricing as high as they could have. Now, while I'm not naive enough to think suppliers have priced their products for perfectly maximum profits, I do think most are in the ballpark.

Just think about it. If you have 100 widgets to sell, and you can sell every single one of them priced at $100, or you can sell every single one of them priced at $125, you're pricing at $125. That's the only circumstance where the entirety of a 25% tax could be passed on.