-

Posts

116 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Everything posted by Esque

-

Kenny Paxton/Dave P's Impeachment Game Day Thread

Esque replied to atomheartbevo's topic in Cloak Room

For the life of me I do not understand the cohort that is defending him and trying to turn this into a R v D issue. -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in Business and Markets

@Chopper - CRE debt is usually 2, 3, 5, 7, or 10 year terms. The longer the term, the more punitive the pre-payment penalty. Lots of GPs took on short-term debt in hopes of a quick exit and now find themselves caught in a rate hike cycle. @gmr548 - There's going to be different types of distress in different product types. As you stated, office has some fundamental headwinds. Meanwhile, multifamily and industrial have capital markets headwinds as a result of GPs paying too much for assets and being far too aggressive in financing. These dynamics are infrequent, perhaps even say rare, in higher quality Class A multifamily where institutional players sit. However, there were a lot of GPs syndicating retail capital and buying assets at ridiculous prices in B and C multifamily and industrial and those are who will be squeezed the hardest and wiped out. @HamsterHookah - The hell if I know. I guess in the short term - stay liquid. RE is an incredibly slow moving ship and you'll likely see opportunities in the public markets before you see meaningful distress in real estate. If you have the risk appetite and the abilities to complete due diligence on the capital stack of these poorly positioned GPs, there's probably a play there. Figure out who the debt is and who will be taking credit losses and look to bet against them via a shot, put contract, default swap, or other such similar means. I'm too much of an alpha head and really want to stick to fundamentals or special situations. Getting into the short side of things just isn't in my personality to dig into it. -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in Business and Markets

Honestly - and I don't want to get into too much of the details online - this was just the elevator / sales pitch to attract capital. These syndicators were / are charging outrageous fees to unsophisticated LPs. I saw a deal where day one the deal was carrying an acquisition fee, capital markets fee, platform fee, financing fee, guarantor fee, construction fee, asset management fee, leasing fee, property management fee, and some other unreal line items. If you were a LP that invested $100 you lost $15 the day you stroked the cheque and the Sponsor pocketed that $$$. So in the short-term, many of them have made millions and millions by fee chasing and in many cases defrauding investors. Good for them. But in the long term, their names will be destroyed and the investors will file numerous lawsuits once they realize their $500k, which is 50% of their retirement, is now worth $0. As you may be able to tell, I'm extremely frustrated with the situation because these charlatans are going to end up decimating so many retirement accounts and I feel extremely sad for these LPs. Especially given so many still don't really understand what they go themselves into. -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in Business and Markets

Racoon = MF syndicator GP Cotton Candy = Their investors' money Goofballs like this are just the tip of the iceberg: https://www.wsj.com/articles/a-housing-bust-comes-for-thousands-of-small-time-investors-3934beb3 1. Purchased $300M of Houston B/C MF last year with $75M of equity. And... it's gone. 2. Raised $12M for a deal and put it all down as EM. And... it's gone. -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in Business and Markets

Thank you for this - gave me a good laugh. But also a good reminder of how the general public does not understand what is going on in real estate and thus why so many get caught offsides when the tides go out. Not even trying to make a dig, but will provide some insight below. Keep in mind, keeping this very simple and high level. Valuations Commercial real estate valuations are based on capitalization rates, which are just inverse multiples. So a 20x EM is the same as a 5.00% capitalization rate (1/20). Capitalization rates for stabilized assets are generally priced on an equity risk premium spread to the risk free rate. The US10Y is often used. The capitalization rate is applied to net operating income which in its simplest terms is revenue minus expenses. So let's make some basic assumptions: NOI is $10, NOI is flat y-o-y, and Class A MF in DF/W trades at 180 bps spread to the US10Y. Well what just happened in the last 18 months? The US10Y went from 1.5% to 3.8%. So market capitalization rates went from 3.3% to 5.6%. So the value of the property went from $300 to $180, (40%). This is purely a function of the capital markets. Net Operating Income Market rent growth remains positive and vacancy remains very low. But, many owners are getting killed by year-over-year increases in property tax and property insurance. As a result, net operating income year-over-year is negative - further hurting valuations. Financing This is where the rubber meets the road. Because all of the above is pure accounting and on paper until the property has a transaction. If you're a current owner, why would you sell today unless you have to? Well, here we go... Commercial loans are term loans with covenants. The most common terms are 3 and 5-years. Lots and lots of transaction in 2020 and 2021 were done with 3-year term paper because a lot of buyers through rates would stay very, very low. So let's say a buyer bought a property for $100 with $75 of debt and $25 of equity. Today all of the equity is gone AND $15 / $75 is gone on the debt. When the term matures, the lender comes and wants to be made whole. The owner has two options. First, they can do a "cash-in refinance" meaning they need to go back to their investors and ask them for a 60% ($15 / $25) equity injection via a capital call. The second is they can't achieve this and they have to default. The other issue with financing today is the same borrowers that were using high leverage, 3-year debt were the most likely to take on floating rate debt with rate caps. As those rate caps have been expiring they have been seeing massive increases in their debt service because their effective rate went from say 3% to 8% overnight. The property can not service the debt and they go into technical default, which then has to be worked out. There's obviously much more to this. But needless to say, these is a massive capital markets issue out in the market that isn't being discussed fully. There's way too much on the shitty fundamentals of office and not enough people understand there's too much leverage in MF and industrial. It takes time for this all to play out and as more borrowers come under pressure as their debt rolls over, the worse it will get. The "maturity wall" as it was really kicks off later this year through 2025. Hence you will have a new "survive to '25" mantra in CRE which was an inside joke back during the savings and loan crisis: "survive to '96". -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in Business and Markets

It all comes down to i) the lenders and ii) the government. For the lenders, it is all game theory. The more everyone can work out loans and kick the can, the better for all - until one person can't, they sell loans at a loss, and they effectively force a mark to market of everyone's loan books and you see more calling of lines of credits and loans from lenders. I've been watching a few key assets for 24 months now and many of them have been able to roll and extend for 12 months, much to my surprise. But many of these deals are dead - equity is for sure wiped out and debt may be sitting on 85/100, but marked 100/100. This is all to say, you still have another 12 months or so. The defaults in office are not going to surprise anyone. The defaults in MF will and that is what will catch a lot of people offsides. But will be a good time to pick up blue chip public REITs as NAV gets punished by short term market volatility - or so I guess. In many ways the public markets have already front run the private markets. -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in Business and Markets

Yeah, lots of folks getting SMOKED on taxes and insurance y-o-y. Going back and looking at some u/w versus actuals is sort of hilarious. -

We started watching the new season. Perhaps our sense of humor, but this is my favorite show in years. Just lots of good gags and very dark, Russian humor.

-

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in Business and Markets

You have no idea. Seeing some of these deals under "rescue capital" terms and even with super attractive terms wouldn't touch them with a 10 foot pole. Some of these fools are still underwriting low 4% cap rates on deals when trying to raise capital to save deals. It's going to be a mess. -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in Business and Markets

Interesting. Is pulling the lever on fees versus points due to HPML risks? So staying within that spread to APOR by adjusting fees as well? Is there a limit to these fees to remain a QM? So basically playing with two main levels - points and rate? -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in Business and Markets

Curious - What's the general rate spread between say a sub-prime (<620), near-prime (620 = 660), prime (660-720) and super-prime (720+) borrower? If the national average 7.00% is for the prime borrower, does it stack up something like this? Sub-Prime: 8.00%+ Near-Prime: 7.40% Prime: 7.00% Super Prime: 6.40% - 6.60% How high are rates for some of these first time buyers using FHA with 580 credit, which I think is minimum credit score required with 3.5% down for FHA? -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in Business and Markets

Yeah, really don't get what all the panic is about. We've known we're going down this road for over a year now. Nothing about this is surprising nor will it surprise me when they reach a deal at the 11th hour and kick the can down the road AGAIN instead of addressing fundamental financial issues we have. -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in Business and Markets

How are you mortgage brokers competing against the homebuilders in submarkets where homebuilders are active? Looks like they're buying down rates anywhere from 1.50% - 2.00% plus other incentives. So if market today is circa 6.50% they can get down to let's say 4.50% - 4.75%. How in the world does the buyers down the street compete with that if they want to sell? Or they could potentially be screwed for years until the builder is done and out of their community? Or take a huge equity cut to get the sales price down enough to compensate for rate differential? Seems like a fubar situation. -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in Business and Markets

2YT ripping this morning. 10YT should follow? -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in Business and Markets

I'm not struggling to find the article, but there were some statistics released of percent of total mortgages under 3% and under 4%, which were eye catching. Given the environment, if you're locked into one of these mortgages - why would you EVER sell? Would just hire a property management company and rent it out. Free money given cost of capital. At the bare minimum wait for a few years since carrying costs is so low and you'll get solid rent in the meantime. This is one of my biggest concerns. We had so much activity in new home sales and refinancing that there's zero reason to move if you're locked into a good rate. This artificially restricts supply and encourages current owners to rent before they consider a sale. Will only sell if they absolutely have to, and even then why would you sell then buy into a market at 6.50% interest rates? The knock on your monthly payment is huge. Better off to sit still and improve your current home to make it work for a few years. -

Grapevine/Coppell/Southlake/North of DFW dining recommendations

Esque replied to BearSchlong's topic in Dallas

George's Coffee and Provisions in Old Town Coppell for coffee Ramen Hakata off E Round Grove Rd for Ramen Hard Eight BBQ in Old Town Coppell for BBQ Parma Pizza & Pasta off E Round Grove Rd for Italian Anamia's off Denton Tap for Tex-Mex Siam Thai Cuisine off MacArthur for Thai Victor's Wood Grill off Denton Tap for American Fine J Macklin's Grill off Denton Tap for American Casual Coppell Deli in Old Town Coppell for Diner food -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in Business and Markets

Any thoughts on the market digesting the increased pace of QT by the Fed that began this month? Given this is primarily going to be MBS, shouldn't that further impair values by driving increased volume? Or realistically, too many moving pieces in secondary market to know how it all plays out in reality? -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in Business and Markets

Mortgage rate just jumped to 6.23% today, up almost 25 bps. Crazy… Sent from my iPhone using Tapatalk -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in Business and Markets

Anyone deal with the home builders? With rates up to almost 6.00% after today, expect we'll see another uptick in cancellations? -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in Business and Markets

@HRSchenker I get the frustration and friction, but this is largely out of municipalities' hands. This is a matter of administrative law and has to do with the laws and rules of Texas occupation code. The power bequeathed to municipalities largely revolves around land use and which improvements can be constructed upon said land. The operational use of said improvements comes down to occupations code. What needs to be regulated is too difficult to regulate and that's the rub. Technology has enabled a unique occupation model in which the same improvement can reasonably be used for long term occupation and short term occupation interchangeably. Whereas historically there was more of a distinction between the two. I don't know what code or regulation is reasonably going to manage this without creating some administratively nightmare, which is not what we need. For example, you could use the fire department to limit all residential dwellings to a capacity of one person per bedroom to mitigate STR impact. However, you'd also be fucking over a lot of student housing, family housing, and so forth. It just doesn't make sense. Municipalities have tried, but they're grossly overstepping their authority. And have been called out on it a few times. -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in Business and Markets

@Wulaw Horn What do you watch in a market like today's to see where loans are going? Obviously watching the MBS market, but any specific trades or what not? Super curious if rates pop further after a day or two more like today and get up to 6.00% soon. -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in Business and Markets

Let's assume Fed announces 50 bps today and $50 - $75 Bn b/s run off on a go forward basis. Most, or at least a lot, of b/s run off is going to be MBS. So rates jump from let's say 5.35% to what? 6.50%? How bad does Fed selling (which also means stop buying) in the MBS market whack spreads? How and when does this translate to pricing in residential? Seems crazy that we're still seeing price increases. Something has to give? -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in Business and Markets

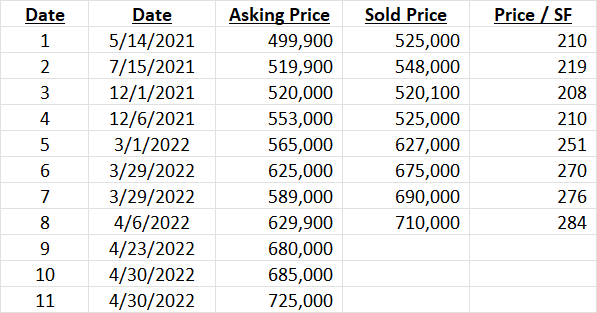

This market is just silly. Here are some metrics for a small town home development (about 125 homes) we have been keeping an eye on. These are all very vanilla, down the fairway homes from Darling Homes built in either 2013 or 2017. So they are newer (relatively speaking) and are all 2,500 sq. ft., 3/2.5 with a study. -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in Business and Markets

Completely agree with this. Part of this, unfortunately, is simple economics. The home building industry has consolidated over the last several decades and thus is more of an enterprise endeavor these days. You'd still be shocked at how inefficient it is, but is is all on a relative basis in that it is more efficient than it once was. Over time, the largest home builders ("nationals", "publics") have figured out the obvious, which is incremental square feet via an office, dining room, and/or fourth bedroom is accretive to the bottom line because the fit-out of these spaces is limited, i.e. just more lumber and dry wall. So the house that used to be a 3 bedroom, 2 bathroom, 1,500 sq. ft. home is now 4 bedroom, 2 bathroom, 2,600 sq. ft. This has made the median house less affordable to the median household income. But is accretive to the home builders. Another part of this is competition on the home building side. The Global Financial Crisis wiped out a lot of the local and regional home builders who didn't have the balance sheets to weather the storm. Yes, the nationals and publics got hammered, but they had the balance sheet to weather the storm. So an even larger percentage of overall production is through a fewer number of builders who increasingly control the market, especially on the land side. Capital markets has also accelerated this trend during covid-19 as office and retail, which have been favored for capital allocators due to cheque size, are obviously much more risky and are out of favor. Thus, more capital than every is flooding into multifamily, industrial, and residential. Capital allocators are buying up houses in lots from home builders and renting them out. Thus, the number of homes available to end users is that much less and thus competition is driven up. Would guess somewhere between 1 out of 4 or 5 homes today are purchased by investors. I don't see this trend reversing anytime soon unless we completely roll back time and everyone is back in the office full time - unlikely. Without going on too much longer, let's never forget the increase on soft costs and politics of dealing with the city. This is a newer phenomenon and is getting worse and worse. But will leave that alone for now beyond stating the obvious, that is limits new supply. As a result of this, and many other considerations, you will have more and more households renting. It is just a reality. And completely agree it is bad for society. -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in Business and Markets

The Good: We finally found a home after searching for 18 months and putting in just shy of 15 offers. The Bad: The husband refused to fully execute the contract last second, stating that he just couldn't sell the house they raised their family in. The Ugly: I laughed hysterically when we got the call because our search has been such a shit show, of course this would happen. The wife cried and was upset all night. On to the next one. The great news is there were only five offers on the home, whereas prior homes have had anywhere from 25 - 50 offers. So seems to be cooling down quite a bit. I'm curious, what do you think happens to rates as Fed begins QT in the open market and floods it with the MBS they purchased over the last two years? Presumably this is already priced in? Or not necessarily?

Football ... Basketball ... Baseball ... Other Sports ... Futbol ... 🤫995🤫 ... Gambling ... Movies & TV ... Music ... Hobbies ... Lulz ... Food & Travel ... Daily Texan ... Business and Markets ... Cloak Room ... Help ... For Sale ... Board Discussion ... Subscribe!... Donate!... COOKIE MONSTER!