billfromlaketravis

Legacy Members

-

Joined

-

Last visited

-

Currently

Viewing Topic: Transfer Cycle 2025-2026 - Stop Being Poor

Everything posted by billfromlaketravis

-

SEC Catch-all Thread

I hope Thamel has a Lane chapter in his next book. Florida very publicly fumbled the bag twice.

-

Could this be the craziest coaching carousel of all time?

I wasn’t aware Morris was staying with his team. Good for him. Hopefully Sumrall does the same thing when he gets a bigger job in the near future. I don’t like the idea of a CFP team not having a head coach for the biggest game in school history.

- ATTN: SHEEPFUCKERS (Week 15 2025)

-

Could this be the craziest coaching carousel of all time?

I hate the coaching carousel. Watching the North Texas game. Their HC is gone and they might be playing for a CFP appearance. Morris will almost certainly take their QB with him after the season. Tulane could be a similar position by tomorrow. So now the CFP matters, but only at certain places? This is damaging the sport.

-

2025-26 Houston Rockets Thread - Back to Contention?

I like where your head is at. I think the buyout market is going to be pretty robust in February. I’d prefer McCollum.

-

2025 Egg Bowl - Ole Miss vs. MSU

Yep. Money. I can’t blame GT. They are in the ACC. https://www.onlineathens.com/story/sports/college/bulldogs-extra/2025/11/27/georgia-football-georgia-tech-ryan-alpert-mercedes-benz/87479622007/

-

2025 Egg Bowl - Ole Miss vs. MSU

So Georgia bullied GT to play in at the Mercedes-Benz dome? Just another reason to dislike those assholes.

-

Could this be the craziest coaching carousel of all time?

So if LSU misses on the Lane Train, they’re all in on Brady right? Will Stein would do well there, but I think they’d go with Brady because of his LSU ties.

-

Could this be the craziest coaching carousel of all time?

I how he stays. I probably hate LSU more than piggy.

-

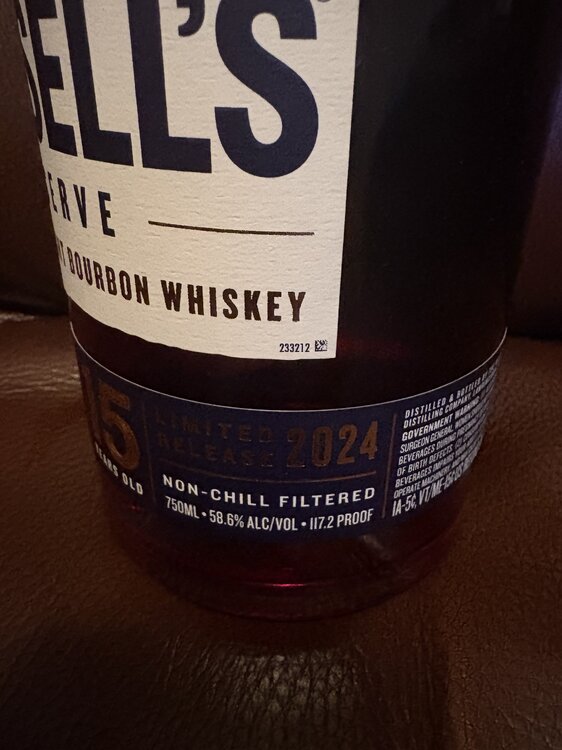

Bourbon

-

2025-26 Houston Rockets Thread - Back to Contention?

Yeah I didn’t want to mention Jalen in my original post. Thinking about Mobley or Barnes on the current team is painful and pointless. I love the current roster. I’d sign Eason to a 1 year deal next summer and then let him walk. It seems to be the path for most RFA. Need to draft a replacement in the 2027 draft. Hopefully the Nets pick is top 5.

-

2025-26 Houston Rockets Thread - Back to Contention?

I guess we’ll disagree on Barnes being better than Alpie and agree on the depth and quality of the 2021 Draft.

-

Pluribus - Vince Gilligan and Rhea Seehorn

The body bags were the length, width , and height of a human body. It’s people folks.

-

2025-26 Houston Rockets Thread - Back to Contention?

The Athletic’s NBA Daily podcast recently redrafted the 2021 draft, and they had Alpie 4th. Madness. I get Cade at 1. Mobley at 2 is debatable. Alpie is hands down better than Scottie Barnes. These guys are prisoners to All NBA Teams. 1 each for Cade and Mobley. Barnes was injury replacement in 2024. Alpie outright made an All Star team last season and is cruising for All NBA this season.

-

Could this be the craziest coaching carousel of all time?

Played it exactly like a guy that gets his mail at titters.

-

2025-26 Houston Rockets Thread - Back to Contention?

Butler had the quietest 21 points in recent memory. I don’t remember him doing anything that stood out. Steph was off, but the Rockets defense played him really well. I forgot about Draymond for large stretches of the game. He’s not really disruptive on defense anymore unless he’s playing Dillon Brooks. Their only prayer is a for a star to ask out and demand a trade to the Warriors, and for the other team to accept pennies in the dollar on the return (Kuminga and some late firsts). They need very favorable draws in the playoffs to make some noise. But they’re dead as long as they Steph and Kerr.

-

2025-26 Houston Rockets Thread - Back to Contention?

Me watching Reed grow up against the hated Warriors and Steph last night. Please forgive my Castle blasphemy Lord Sheppard.

-

2025-26 Houston Rockets Thread - Back to Contention?

Curry is such a cuck. Fakes an injury and just leaves early. Be a man you fucking bitch.

-

2025-26 Houston Rockets Thread - Back to Contention?

We’re down about to go 20 without Reed. Please forgive me Cocaine Curry.

-

2025-26 Houston Rockets Thread - Back to Contention?

Sheppard decided to show up tonight. He’s alone.

-

2025-26 Houston Rockets Thread - Back to Contention?

Not happening tonight. The officiating will doom us. Please stop me if that’s happened before.

-

2025-26 Houston Rockets Thread - Back to Contention?

Okogie is the worst finisher in the league? If there’s a body that’s alive and moving to contend the lay up, he will miss it.

-

2025-26 Houston Rockets Thread - Back to Contention?

Tate is ass cheeks. There’s not another side of the argument.

-

2025-26 Houston Rockets Thread - Back to Contention?

Sheppard balling. Capela going full on 2015 is pretty wild.

-

2025-26 Houston Rockets Thread - Back to Contention?

Goddamnit ESPN. Stop this shit. You know the average NBA game is 2 hours 45 minutes to 3 hours. The hubris of trying to jam 3 NBA games into 4pm to 11pm window is deeply stupid.