-

Posts

15023 -

Joined

-

Days Won

8

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Everything posted by bolverk

-

Understanding what's moving the market and where it will go is now more a matter of comprehending the psychology of a single man and how investors respond to his megalomania than anything you might have learned in B school.

-

"We" aren't sinking the ship. "We" don't have any power to that. "We," however, have been sounding this alarm for fucking years, but the moderates in the middle have the memories of goldfish. If you are a Gen Xer, every single Republican administration that you've experienced as an adult has ended in an economic disaster: Big Bush, Shrub, and Trump. And every single Democratic administration has had to clean up his predecessor's mess. One would think that people of normal intelligence could maybe pick up on a fucking pattern by now and consider that maybe those loony leftists know what the fuck they're doing and talking about. After trying -- repeatedly and desperately -- to point shit out, sometimes you just get worn down, and all you have left is falling back on bitter and angry ridicule.

- 2370 replies

-

- 16

-

-

-

-

-

Got stumped on both Wordle and Connects and had to step away. That helped with the former but not the latter. I ended up just saying "fuck it" and plowed ahead after a while and plowed ahead into wrongness. Wordle 1,388 4/6 ⬛🟨🟨⬛🟨 ⬛🟨🟨🟨⬛ 🟨⬛⬛🟩🟩 🟩🟩🟩🟩🟩 Connections Puzzle #666 🟪🟩🟩🟩 🟨🟩🟦🟨 🟦🟦🟦🟦 🟨🟨🟨🟨 🟩🟪🟩🟩 🟩🟪🟩🟩 🙂 Daily Quordle 1169 7️⃣4️⃣ 6️⃣5️⃣ m-w.com/games/quordle/ ⬜🟨⬜⬜🟨 🟩🟨⬜⬜⬜ ⬜⬜🟩⬜⬜ ⬜⬜🟩⬜⬜ ⬜⬜⬜⬜⬜ ⬜🟨⬜⬜⬜ ⬜🟨🟩⬜🟨 🟩🟩🟩🟩🟩 ⬜⬜🟨⬜⬜ ⬛⬛⬛⬛⬛ 🟩🟩⬜🟩⬜ ⬛⬛⬛⬛⬛ 🟩🟩🟩🟩🟩 ⬛⬛⬛⬛⬛ ⬜🟨⬜⬜🟨 ⬜⬜🟨🟩⬜ ⬜⬜⬜⬜🟩 🟩⬜⬜🟨⬜ ⬜🟨⬜⬜⬜ ⬜⬜⬜⬜⬜ ⬜⬜⬜🟨🟨 ⬜⬜⬜⬜⬜ ⬜⬜🟨⬜⬜ 🟩🟩🟩🟩🟩 🟩🟩🟩🟩🟩 ⬛⬛⬛⬛⬛

-

It's a helluva thing that Ford makes some kick-ass smaller cars for the European market that compete pretty well, but not in the US of fuckin' A where you can't buy a normal gotdam car from them anymore.

-

-

Wordle 1,387 4/6 ⬛🟨🟨⬛⬛ ⬛⬛🟩🟨⬛ 🟩🟨🟩🟨⬛ 🟩🟩🟩🟩🟩 Connections Puzzle #665 🟦🟦🟦🟦 🟨🟨🟨🟨 🟩🟩🟩🟩 🟪🟪🟪🟪 🙂 Daily Quordle 1168 6️⃣8️⃣ 4️⃣5️⃣ m-w.com/games/quordle/ ⬜⬜🟨⬜🟩 ⬜⬜🟨⬜⬜ ⬜⬜⬜⬜🟨 ⬜⬜⬜⬜🟩 ⬜⬜🟨⬜⬜ ⬜🟨⬜⬜⬜ ⬜⬜⬜🟨🟨 ⬜⬜⬜⬜🟩 ⬜⬜⬜⬜⬜ ⬜⬜⬜⬜⬜ 🟩🟩🟩🟩🟩 🟨⬜⬜🟨⬜ ⬛⬛⬛⬛⬛ 🟩🟩🟩⬜🟩 ⬛⬛⬛⬛⬛ 🟩🟩🟩🟩🟩 🟩🟩⬜⬜🟨 🟩⬜⬜🟨⬜ ⬜⬜🟩⬜🟩 🟨🟩⬜⬜⬜ ⬜⬜⬜⬜⬜ ⬜⬜⬜⬜⬜ 🟩🟩🟩🟩🟩 🟩⬜⬜⬜⬜ ⬛⬛⬛⬛⬛ 🟩🟩🟩🟩🟩

-

I'm loving this episode! And yeah Sherman is low key hawt. ETA: She's got that jolie laide, as the French say, thing going on.

-

Gothic on Vacation had me rolling.

-

Jack Black's "monologue" was great!

-

Elon Musk: Nazi traitor piece of shit [Confirmed]

bolverk replied to MaybeACoordinator's topic in Daily Texan

-

Right. But as the article suggests, we won't be getting solid numbers from all the stuff they look at for a while. Therefore, no rate drops should be expected anytime soon.

-

17 year old stabbed to death by another 17 year old at Frisco track meet

bolverk replied to Derka's topic in Daily Texan

I don't know why you guys are trying to reason with GRU. Despite his original post excoriating this board for not discussing certain issues in its six pages, e.g., the tent and knife shit, all of his points have indeed already been discussed. Y'all are talking to a liar who claims to have already read this entire thread, a troll trying to rabble rouse, or a stupid motherfucker who has the memory of a goldfish. Put BJ Johnson, the aforementioned GRU, a prick who's been banned from this site 30-something times, on ignore. Please don't engage that asshole. -

Based on this article, it doesn't sound like the Fed will be lowering rates any time soon -- unless, of course, Trump somehow got away with firing Powell. The Fed Isn’t Rushing to Save the Markets This Time With stocks in a steep decline and tariffs inducing recession jitters, the patience of investors may be tested. The notion that the Federal Reserve will rush in to rescue investors in a crisis has comforted investors for decades. But in the big market downturn induced by President Trump’s tariffs, no Fed rescue is in sight. Jerome H. Powell, the Federal Reserve chair, made that clear on Friday. The tariffs are much “larger than expected,” he said, and their immense scale makes it especially important for the central bank to understand their economic effects before taking action. “It is too soon to say what will be the appropriate path for monetary policy,” he said at a conference in Virginia. In fact, I’d say, the likelihood of further market declines is much greater than the chance that the Fed will turn the markets around in the immediate future. What U.S. stock investors have experienced until now is what’s known on Wall Street as a correction — a decline of 10 percent or more from a market peak. The correction doesn’t end, by this common definition, until the markets have turned around and that peak has been surpassed. For days, though, the market momentum has been almost entirely downward. So another dubious distinction is in sight: a bear market, which is a decline of at least 20 percent from a market top. For the S&P 500, which closed at 5,074.08 on Friday, down from its peak of 6,144.15 on Feb. 19, a bear market is already within shouting distance, a scant 2.6 percentage points away. It would be lovely to be able to say that the stock market bottom is near, or that it has already been reached, Edward Yardeni, a veteran market watcher, said in a conversation on Friday. “I’ve been pretty good at picking market bottoms, and I’m not shy about calling one when I see one,” he said. “But that usually has happened when the Fed has taken action. And right now, its pretty clear that Powell won’t be doing that.” The Fed is holding back this time for good reasons. The impact of the sudden new range of tariffs imposed by the president — and the tit-for-tat tariffs announced on Friday by China that are likely to be followed by similar moves from a host of other countries — is far from clear. But this much is certain. Tariffs are a tax, one that is likely to slow economic growth as well as raise prices. Those effects complicate the task of the Fed, which has a dual mandate: promoting full employment (and economic growth) and holding the rate of inflation down to a reasonable level. With the Fed still battling inflation after the runaway surge in prices of 2022 and 2023, it is reluctant to lower interest rates when price increases in a range of goods could be just around the corner. And on Friday, the latest jobs report from the government showed that the economy in March remained reasonably strong. Employers added 228,000 jobs for the month, far more than anticipated, and while the unemployment rate rose slightly, to 4.2 percent from 4.1 percent, there were few signs of substantial weakness. Given that backdrop, Mr. Powell seemed to be signaling that it would take an actual slowdown, with substantial job declines, to justify rate cuts under current circumstances. Consumer confidence has declined, and an Economic Policy Uncertainty Index that is closely watched by economists and business executives has soared. But concrete data isn’t here yet. If they’re not rolled back, the tariffs are likely to take a while to result in widespread layoffs — and without strong evidence of a slowdown, the Fed may be reluctant to act. Yet the Fed has already come under pressure from President Trump to lower interest rates. This is the “PERFECT time” for a Fed rate cut, he said on the Truth Social media platform on Friday, shortly before Mr. Powell’s speech. Maintaining Fed independence is important in the markets, and there was no indication that this overt presidential pressure had any effect on Mr. Powell’s staunch resolve to bide his time, and to lower interest rates only when and if the Fed decided it was time to do so. So investors may need to be very patient, and to hope that changes in tariff policy occur rapidly enough in Washington to turn the markets around and, more important, avert a recession. Recessions are typically associated with wide-ranging job losses, and they cause immense hardship in the real world as well as in financial markets. cont'd:

-

Austin Public Health loses $15 million to federal grant cuts Austin Public Health is losing millions in funding and 27 full-time employees due to cuts at the federal level, the agency's director said. Five of Austin Public Health's grants have been eliminated so far, resulting in the loss of an estimated $15 million over time. That money paid for APH’s Refugee Services Clinic, COVID vaccination program and diabetes care program, among other services. APH did not specify the funding agency for all of the lost grants. The Department of Government Efficiency has made cuts at a number of federal and state health organizations. Last week, it announced it would terminate hundreds of millions of dollars in grants to the Texas Department of State Health Services, including some COVID-era funding that was distributed to local health departments. At an Austin City Council public health committee meeting Wednesday, APH Director Adrienne Sturrup described learning about the cancellation of funds that filter through the Texas Department of State Health Services, one grant at a time, across recent weeks. "I've called it death by a thousand cuts," she said. Sturrup expressed concern about more cuts that could be coming. “There is no federal windfall that’s going to come through to support our efforts,” she said. “It will really be, unfortunately, us taking a hard look at what are the things that we just can't support, and where we're going to have to turn to the community for help.” Sturrup said APH is working with Austin City Manager TC Broadnax to find open positions in other city departments for the affected employees. But APH representatives said they anticipate an additional 28 full-time employees could lose their jobs. APH’s 2025 fiscal year budget included around $39.4 million in grants — around 30% of its total budget. Grants pay for about half of full-time positions at the agency. Some of the lost dollars were associated with COVID-era grants, but Sturrup said that funding helped the department to respond to other threats including mpox and measles. “Public health nationally has historically been underfunded. The additional dollars that came through from the pandemic not only gave us the opportunity to scale up to respond to the community's needs, but in some ways to right-size,” she said. “That is one of the reasons why the state health department allowed locals to continue to use those funding dollars after the pandemic ended.” Sturrup said APH is working with City Council to extend certain affected programs with local funding — but some may shut down entirely. One program in limbo is a clinic that provides vaccinations and medical support to refugees and asylum seekers. “We will be able to float that program for a little bit longer," Sturrup said. But there are no guarantees about the program's future. Sturrup said similar programs from agencies in other jurisdictions have had to shut down. "They can't afford to take the risk to continue to provide services with the uncertainty of reimbursement,” she said.

-

Stolen from the comments.

-

Wordle 1,386 4/6 ⬛⬛🟩⬛⬛ ⬛⬛🟩⬛⬛ ⬛⬛🟩🟩⬛ 🟩🟩🟩🟩🟩 Connections Puzzle #664 🟩🟩🟩🟩 🟨🟨🟨🟨 🟦🟦🟦🟦 🟪🟪🟪🟪 Quordle was a little tricky. 🙂 Daily Quordle 1167 5️⃣9️⃣ 7️⃣6️⃣ m-w.com/games/quordle/ 🟨🟨⬜⬜⬜ ⬜🟨🟨⬜⬜ ⬜⬜⬜⬜⬜ ⬜🟨⬜⬜⬜ ⬜🟩⬜⬜🟩 ⬜🟨⬜⬜⬜ ⬜🟩🟩🟩🟩 ⬜🟨⬜🟨⬜ 🟩🟩🟩🟩🟩 ⬜🟨⬜🟨⬜ ⬛⬛⬛⬛⬛ ⬜⬜⬜🟨🟩 ⬛⬛⬛⬛⬛ ⬜⬜⬜⬜⬜ ⬛⬛⬛⬛⬛ ⬜🟩🟩🟩🟩 ⬛⬛⬛⬛⬛ 🟩🟩🟩🟩🟩 ⬜⬜⬜🟨⬜ ⬜🟨🟨⬜⬜ ⬜⬜⬜🟩🟩 ⬜⬜⬜⬜🟨 ⬜⬜⬜⬜⬜ ⬜⬜⬜⬜⬜ ⬜⬜⬜⬜⬜ 🟩⬜⬜🟨⬜ ⬜⬜⬜⬜⬜ 🟨⬜⬜🟨⬜ ⬜🟨⬜⬜⬜ 🟩🟩🟩🟩🟩 🟩🟩🟩🟩🟩 ⬛⬛⬛⬛⬛

-

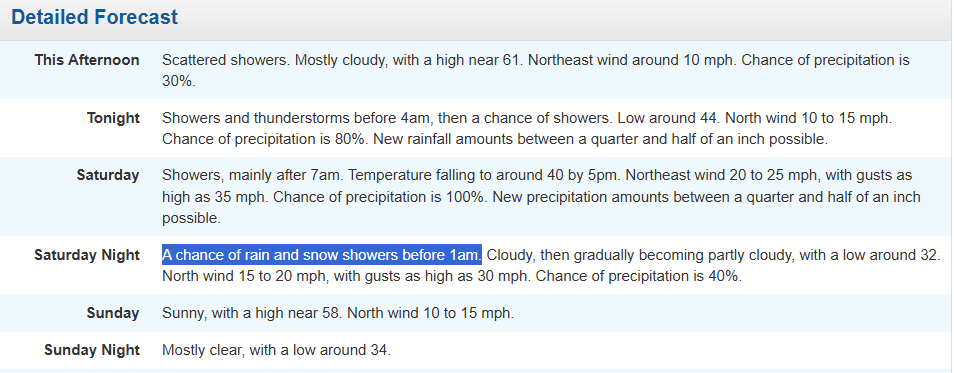

Third night of rain in a row. Tonight's been much heavier, especially this last round. It's been coming in waves for the last 2-3 hours. Glorious. Hopefully, it gets down to you guys soon but not too soon. I want to keep.hooging it for another day or so. Runoff goes into the Colorado River Basin anyway.

-

They're great for the rose bush, though.

-

-

-

Got about an inch of rain spread over the past two nights out here in the wastelands. Just checked the forecast for this weekend and was NOT expecting to see this.

-

GRU

-

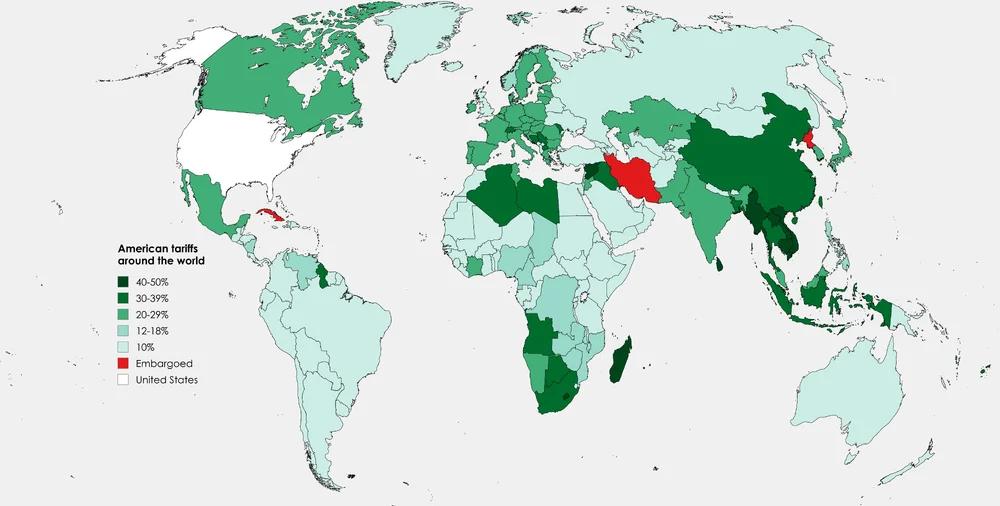

By Justin Wolfers Dr. Wolfers is a professor of economics and public policy at the University of Michigan. These tariffs are going to hurt. A lot. By my calculations, this round of tariffs may be 50 times as painful as the ones Donald Trump instituted in his first term. That means they are going to reshape your life in much more fundamental ways. To illustrate how, let’s look at a prosaic example: your washing machine. In 2018, Mr. Trump’s relatively modest tariffs caused washing machine prices to rise by nearly $100. As a result, many families elected to stick with their aging machines longer than they otherwise would have. But that choice incurred a new set of costs: late-night thuds from unbalanced loads, wads of scrunched cloth still dripping wet after a cycle and higher energy and water bills. In other words, the total cost of a tariff isn’t just what comes out of your checking account. The time you spend to rearrange the stuff in your washer is a cost. The time you spend wringing out sopping wet T-shirts is a cost. Tariffs are costly not just because they raise prices but because they force you to make different decisions that will extract a different kind of cost from you over time. Small tariffs create small problems. Big tariffs create huge ones. Take Mr. Trump’s 25 percent tariff on vehicles, which is expected to raise their prices by roughly $4,000. Many families, like mine, will probably decide not to buy a second car. That creates far bigger problems than an aging washer. Now, we’re constantly juggling how to get our kids to all their activities, and ourselves to work, with only one set of wheels. And it’s not just cars. These are across-the-board tariffs, so they will distort virtually every purchase you make. In each case you’ll have to stop your baked-in calculations, recalibrate and find a way to make do — perhaps substituting frozen vegetables for fresh vegetables, a less effective medication for a higher-priced import, or corn syrup for sugar. And in each case, you’re worse off. By the way, tariffs don’t distort just your buying decisions, they also distort what businesses make. Just as tariffs lead you to buy less desirable alternatives, they lead businesses to channel labor and capital into less desirable — that is, less productive — activities. The tariffs announced on Wednesday are roughly 10 times as high as most other industrialized countries, and higher than the infamous Smoot-Hawley tariffs (of Great Depression fame). Mr. Trump’s latest tariffs will lead folks to rethink not only whether to replace their washing machine — as they did in 2018 — but also their dryers, refrigerators, stoves, groceries, clothes, cars and even everyday essentials. Many of the substitutions we’ll make will be quite painful. If a 1 percent tariff leads you to switch from real guacamole to a pea-based alternative, then you really didn’t care about guac all that much. But if it takes a 20 percent tariff to get you to switch, that’s a sure sign that going without the real thing is a serious hardship. And this is why higher tariffs generate a far greater amount of pain. These forces aren’t independent of each other. They interact. Or in math, they multiply, which means their costs rise in the square of the tariff rate. That leads to some pretty painful arithmetic. The average tariff rate was about 1.5 percent just before Mr. Trump’s election in 2016. He subsequently raised tariffs on steel, aluminum, washing machines, solar panels and many goods from China, but left much of the rest of the economy untouched. All told, by 2019 he roughly doubled the tariff rate, to around 3 percent — and so effectively quadrupled whatever pain the 2016 tariffs were causing. (Yes, two times two is four.). Joe Biden kept some of these tariffs, but Mr. Trump’s latest round pushes our current rate to around 15 times its 2016 level, and so squaring that, it’s 225 times more painful. That’s more than 50 times as large than the cost of Mr. Trump’s first term tariff increase. Perhaps voters pulled the lever for Mr. Trump with warm memories of the good economic times. But the reality of his first term is that there was a lot more tariff talk than action. They were barely more than a bump in the road. This time, they’re a mountain. And so the impact will be more like a crash than last time’s comfortable jolt.

-

Y'all need to start adding @MAROON to these. He's a big fan of this idiocy.

-

Haha! That little @MAROON cunt got triggered for being called out on giving a little heart reaction in agreement with the idiot OP and STILL is too much of a coward to post his thoughts. What a little snowflake!

Football ... Basketball ... Baseball ... Other Sports ... Futbol ... 🤫995🤫 ... Gambling ... Movies & TV ... Music ... Hobbies ... Lulz ... Food & Travel ... Daily Texan ... Business and Markets ... Cloak Room ... Help ... For Sale ... Board Discussion ... Subscribe!... Donate!... Advertise... COOKIE MONSTER!