-

Posts

10314 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Posts posted by Zeus

-

-

Blaming all this inflation on Russia makes no sense. It's like when gas shot up from hurricanes in the Gulf that didn't effect production. Inflation was getting crazy in November '21.

Here's a pipe dream

-

On 3/5/2022 at 6:36 PM, Neonmoon said:

China is supporting Russia. No shit.

How is Russia’s invasion of Ukraine a distraction from China?

Taiwan can be taken under the radar if every one is focused on Russia.

COVID crazies in China ring around the rosey

-

1

1

-

-

-

Only highlight I'm missing is Jorge sitting him down with the right hook

-

8 minutes ago, Junior Miller said:

Kayla Harrison supposedly knows him really well since he was a kid and said he was a shy guy who was boring and was about to get dropped by the UFC so his manager created that trumpy heel persona but the kid took it too far. That's her story anyway.

Does he not have any power at all? For all the shots he got on Masvidal there was no cut and not even any swelling whatsoever. Masvidal didn't look like he had been in much of a fight much less a guy who had been hit repeatedly for 25 minutes. Covington's face looked way worse and he took many fewer hits. I was thinking his style was close to that of Khabib but Khabib was way more fun to watch. I think it's because he didn't just get a guy against the cage and ride out decisions. He finished people once he got then down there.

He'll never be any kind of a draw because he's so dull but my hope is Chimaev gets to him and we can see who's the better grappler. Although it looks like Chimaev has way more power.

Hard to tell with chimaev he's fought zero ranked fighters although picking up Jingling and talking to Dana was pretty funny last night.

He said he wants to be the first triple division champ so there's that. I don't really think he's Khabib 2.0, Islam is much closer. Khabib was a beast because he was really healthy and perfect size to cut a shit ton and make 55 then maul guys because he was bigger + more skilled.

Gilbert Burns is a real test I don't think he's gonna just walk right through him.

-

-

8 minutes ago, Scraps said:

Covingtons wrestling is A+

His shit talking is F-

So fake and whack lolHis little character did get him staying on the UFC roster, then went from fighting nobodies to beating up RDA, Lawler, Woodley and a couple title shots.

I think he's in the Chael Sonnon school of pro wrasslin heel because his fight style isn't enough.

-

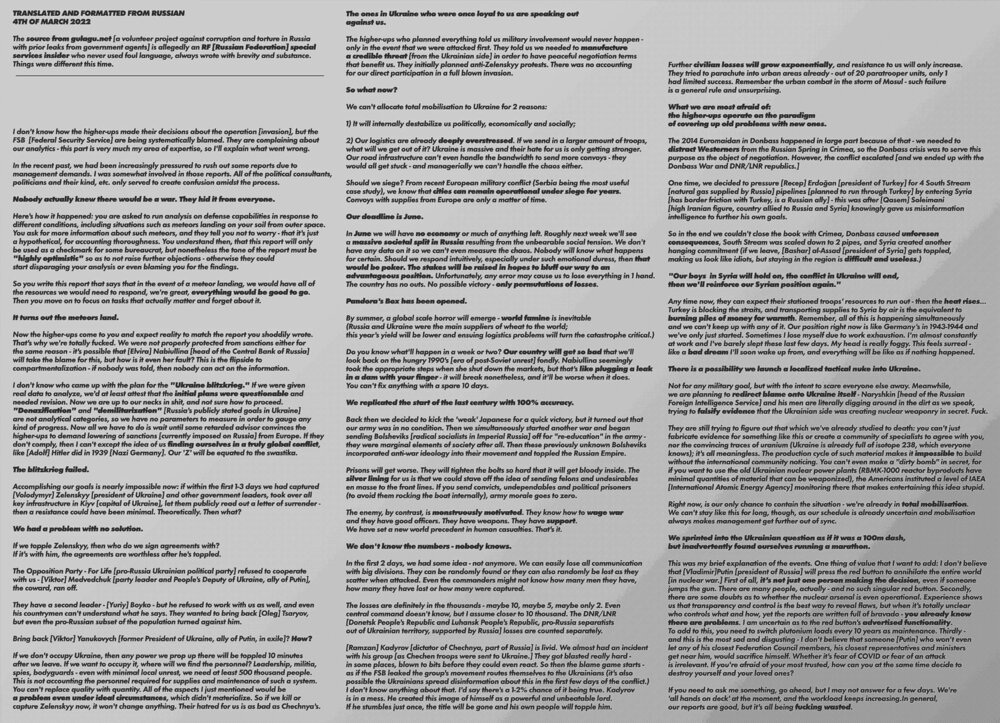

6 hours ago, Neonmoon said:

Use your words

Read and use your mind

-

1

1

-

-

1 hour ago, Neonmoon said:

What are you talking about?

https://www.nasdaq.com/articles/chinas-digital-yuan-may-aid-russia-bypass-swift-ban-but-will-it

-

Quote

The Premier League showed solidarity with Ukraine last weekend following Russia's invasion of the country

There are plans for all 20 sides to take part in similar gestures when they take to the field for this weekend's games

China are therefore considering not showing any of the games from the English top flight

Beijing has denounced sanctions that have been imposed by the UK and the EU against Russia and blamed the US and its allies for provoking Moscow

-

2 hours ago, brakeman said:

Zoom?

-

6 hours ago, Eggo said:

I don't really understand the point of the bubble hate, but I never played ball. What is a new facility going to provide that the bubble doesn't?

Right off the bat the field sucks we messed with it during the South EZ renovation it's almost like the old astroturf.

-

1

1

-

-

-

-

-

4 hours ago, Immaculate Vibes said:

This will be one of the larger effects to come out of all of this.

I hope it was really worth triggering the final descent of the USD as global reserve currency.

“What is money?” is a question that economists have pondered for centuries, but the blocking of Russia’s central-bank reserves has revived its relevance for the world’s biggest nations—particularly China. In a world in which accumulating foreign assets is seen as risky, military and economic blocs are set to drift farther apart.

After Moscow attacked Ukraine last week, the U.S. and its allies shut off the Russian central bank’s access to most of its $630 billion of foreign reserves. Weaponizing the monetary system against a Group-of-20 country will have lasting repercussions.

The 1997 Asian Financial Crisis scared developing countries into accumulating more funds to shield their currencies from crashes, pushing official reserves from less than $2 trillion to a record $14.9 trillion in 2021, according to the International Monetary Fund. While central banks have lately sought to buy and repatriate gold, it only makes up 13% of their assets. Foreign currencies are 78%. The rest is positions at the IMF and Special Drawing Rights, or SDR—an IMF-created claim on hard currencies.

Many economists have long equated this money to savings in a piggy bank, which in turn correspond to investments made abroad in the real economy.

Recent events highlight the error in this thinking: Barring gold, these assets are someone else’s liability—someone who can just decide they are worth nothing. Last year, the IMF suspended Taliban-controlled Afghanistan’s access to funds and SDR. Sanctions on Iran have confirmed that holding reserves offshore doesn’t stop the U.S. Treasury from taking action. As New England Law Professor Christine Abely points out, the 2017 settlement with Singapore’s CSE TransTel shows that the mere use of the dollar abroad can violate sanctions on the premise that some payment clearing ultimately happens on U.S. soil.

To be sure, the West has frozen Russia’s stock of foreign exchange, but hasn’t blocked the inflow of new dollars and euros. The country’s current-account surplus is estimated at $20 billion a month due to exports of oil and gas, which the U.S. and the European Union want to keep buying. While these balances go to the private sector, officials have mobilized them. Stopping major banks like Sberbank from using dollars and excluding others from the Swift messaging system still plunges the economy into chaos, especially if foreign businesses are afraid to buy Russian energy despite the sector’s explicit exclusion from sanctions. But hard currency will probably keep gushing in through energy-focused lenders like Gazprombank, and can theoretically be used to pay for imports and buy the ruble.

Yet the entire artifice of “money“ as a universal store of value risks being eroded by the banning of key exports to Russia and boycotts of the kind corporations like Appleand Nike announced this week. If currency balances were to become worthless computer entries and didn’t guarantee buying essential stuff, Moscow would be rational to stop accumulating them and stockpile physical wealth in oil barrels, rather than sell them to the West. At the very least, more of Russia’s money will likely shift into gold and Chinese assets.

Indeed, the case levied against China’s attempts to internationalize the renminbi has been that, unlike the dollar, access to it is always at risk of being revoked by political considerations. It is now apparent that, to a point, this is true of all currencies.

The risk to King Dollar’s status is still limited due to most nations’ alignment with the West and Beijing’s capital controls. But financial and economic linkages between China and sanctioned countries will necessarily strengthen if those countries can only accumulate reserves in China and only spend them there. Even nations that aren’t sanctioned may want to diversify their geopolitical risk. It seems set to further the deglobalization trend and entrench two separate spheres of technological, monetary and military power.

China itself owns $3.3 trillion in currency reserves. Unlike Russia, it cannot usefully hold them in renminbi, a currency it prints. Stockpiling commodities is an alternative. The conundrum creates another incentive for Beijing to reduce its trade surplus by reorienting its economy toward domestic consumption, though it has proven challenging.

What can investors do? For once, the old trope may not be ill advised: buy gold. Many of the world’s central banks will surely be doing it.

“Even nations that aren’t sanctioned may want to diversify their geopolitical risk. It seems set to further the deglobalization trend and entrench two separate spheres of technological, monetary and military power.”

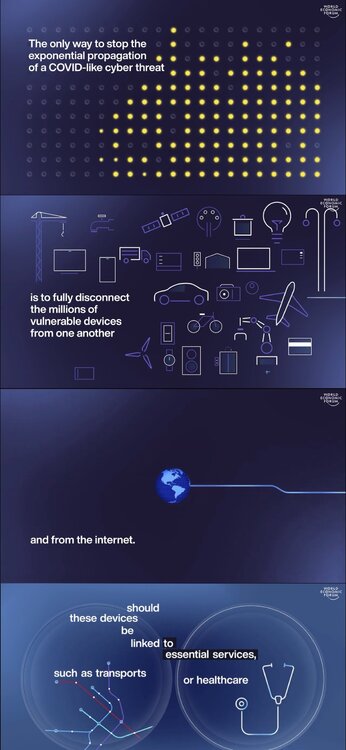

That's the plan, Great Reset after the internet goes out for a couple days.

-

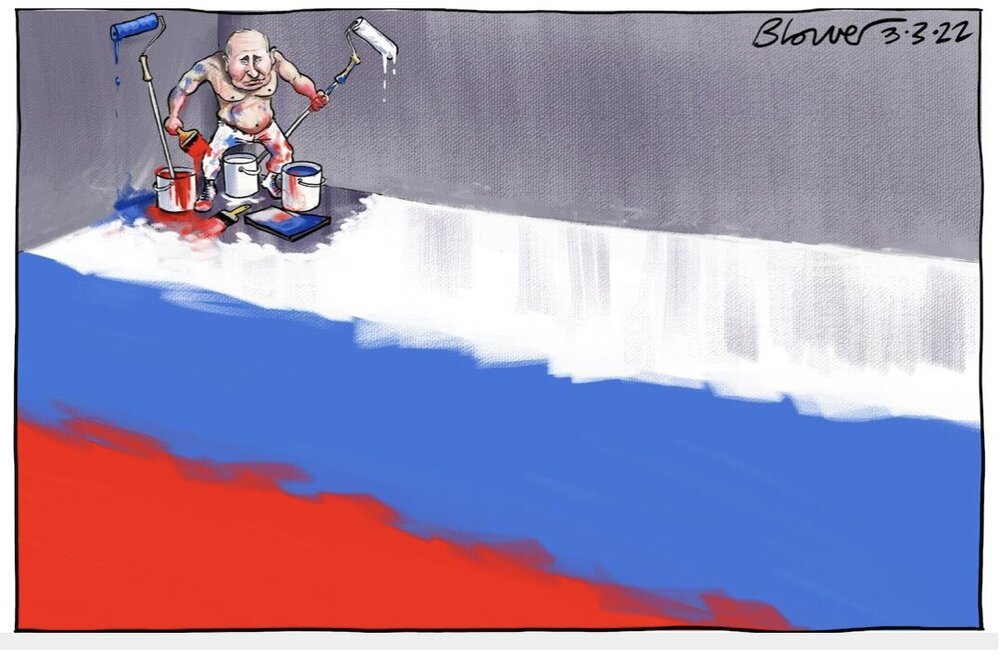

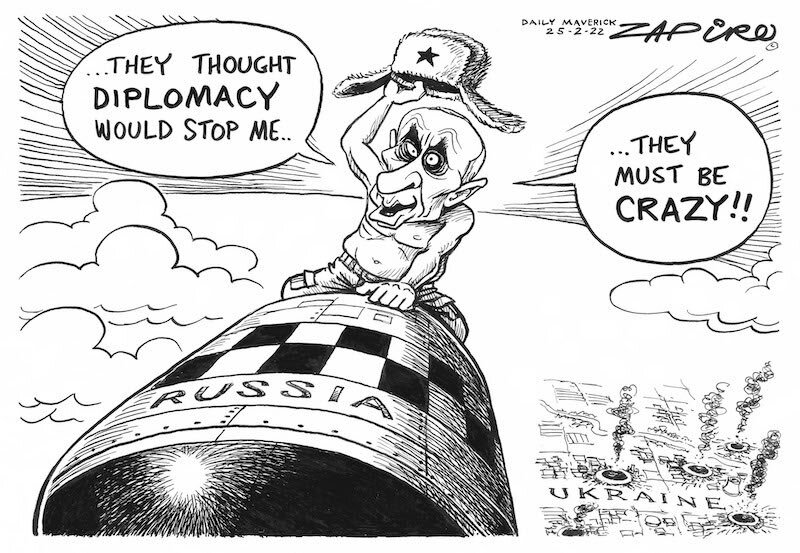

Live look at Pootins master plan creation

-

-

-

On 2/27/2022 at 3:45 PM, GTNY said:

The bubble is so embarrassing at this point. We are so behind on facilities.

It's on the list

SEND IN THE DEMOLITION TURTLE

-

1

1

-

1

1

-

-

-

-

-

25 minutes ago, Nivek said:

Pay them nothing and leave. Let them sue and then hit them with delay delay delay. Then bring in the conference officiating bias as evidence they want Texas to leave. Then sue them for being a fraud of a conference.

-

1

1

-

2021 UFC/MMA thread

in Other Sports

Posted

Yeah Jorge talked about going and camping and growing his hair out for a while and not partying and grew the fuck up a few years ago. He's a solid mother fucker now but still sucks he's separated from his baby momma.