-

Posts

7541 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Posts posted by Wally Fairway

-

-

Just play Rock-Paper-Scissors to determine a winner

-

30 minutes ago, PittsburghTiger said:

Rutgers gonna blow this

Corn & Blue say you can't blue it if we blow it after you

-

3 hours ago, dec3169 said:

Big 12 should make it a requirement that all covid-related make-up games turn into home games for the inconvenienced team. Money talks, and in this case it would say "Put your DAMN mask on and suck it up or Texas gets another million dollars". Actually with covid attendance it probably isn't that much, but those nachos are pretty expensive so it has to be close.

I can't imagine teams make any money on home games right now, but they would save travel expenses and Covid exposure in away locations.

Covid affected teams should be allowed to make games against available teams. MSU is now available, they suck and UT has been game planning for Kansas - so that's a wash.

Should I PM Derka or the Bob's to get this done?

-

39 minutes ago, RPM said:

Boeing wanted to save a brand name (737) but not want to spend the extra money on an all new design and brand name. Fuck the public, go for the cash, where's my bonus. FUPM

It is pretty close to a all new plane - electrically and engines, but by keeping it a version of the 737 they could go through a much more streamlined certification process; and in hindsight that seemed to workout perfectly well

-

-

9 minutes ago, Newy25 said:

I’m not exactly a tin foil hat guy but there sure seems to be a lot of shitty teams getting games cancelled.

It would be a tin-foil thing if Indiana came down with the Rona for this week, to stay 1/2 game ahead of Ohio St (and I would applaud that move)

-

1

1

-

1

1

-

1

1

-

-

1 hour ago, mdmost said:

Probably best for Michigan State

Hell, I'd love to see them do what UCLA & Cal did last week and make a game.

UT has an open date, and hell you were preparing for Kansas anyway

I'm gonna PM Derka and see if we can get this done

-

21 hours ago, BearSchlong said:

She ought to be charged with Kidnapping, basically - because that's what she caused to happen. She caused the state to inadvertently commit kidnapping.

Hell she should have to serve out the sentences of the people who were wrongfully convicted.

What she did was ring a bell that cannot be unrung, those people cannot go back and not serve time for this offense and cannot get custody restored back to the date they lost it due to her fraud.-

2

2

-

-

49 minutes ago, Horn80 said:

Hoping one of these MAC games in coming weeks will be a snow game.

sure it's fun to watch, but really I meant to say Fuck You because I'd likely have to shovel the drive, and find my real winter gear

-

WMU knows that 14 point lead won't be enough

I predict the list has 40+ points

-

Just in case you were wondering how bad it is in El Paso; BBC.com has an article about it on their website, so the international media is paying attention

https://www.bbc.com/news/world-us-canada-54966876

QuoteOverflowing hospitals

With cases going up by more than a thousand every day in El Paso, some 76,000 people have now been infected. That's about the same number of confirmed cases as in the whole of Greece or Libya.

Data shows 1,120 El Paso residents are currently in hospital with the virus, and this number is expected to rise. That means that of all the Covid patients in hospital across the state of Texas, one in six is in El Paso, according to the latest figures. A total of 782 people are known to have died.

Both hospitals and staff are struggling to cope. An El Paso University Medical Center spokesman said the hospital recognised the "physical and emotional" toll the pandemic was taking on healthcare workers.

As officials race to keep up with the rapidly increasing number of sick people, El Paso city's convention centre was recently converted into a makeshift hospital to provide extra beds. Some facilities are so overrun that patients are being airlifted to other cities in the state.

On Monday, El Paso County Judge Ricardo Samaniego said the county had opened 500 extra hospital beds so far, but at the rate the virus was spreading, those beds would be full by next week.

-

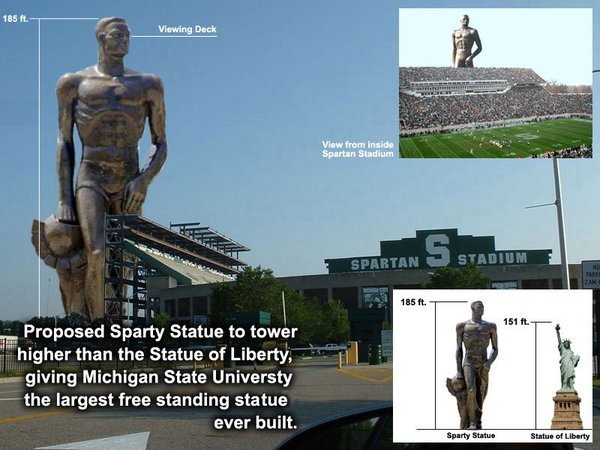

Tune in tonight folks for the battle to determine the best football program in the state (of Michigan)

Live from Kelly Shorts Stadium on the duece; about 40° with wind chill right at freezing

My guess is - first team to 50 wins

-

1 hour ago, Dr. Beeper said:

Who the fuck is Roman?

Is Kelly a total whore? How the fuck isn’t this leaked to the media?

a) Shaggy legend

b) likely, maybe more of an attention whore, as seen as a cam girl and the "I'm getting new tits" thread she started on Shaggy.....most likely she is more of a slut than a whore -

How did I forget it was MACtion day?

checking the scores, and I see defense once again ruled the day

-

On 11/16/2020 at 10:53 AM, Cornfusion said:

Nebraska's best quarterback plays for Rutgers now.

17 hours ago, Bodhi said:The guy that has thrown more INTs this year than TDs? The same one that just lost to Illinois and has only thrown for over 200 yards once in 4 games? That's a bad take and you should feel bad

So you are saying the guy is bad, but you are not saying that he isn't Nebraska's best QB.

did I get that right? (full disclaimer & for the record and until proven otherwise Sparty is about full up on bad QB's) -

On 11/13/2020 at 1:08 PM, smokebomb said:

now that is a celebrity endorsement

not sure why there aren't billboards proclaiming supported by James Hong

-

1 hour ago, 52-80 said:

safest way to guard against theft of ones bank account is to not have any money

-

20 minutes ago, SuperSport said:

So is this POS going anywhere, or is it just bouncing around sub-.0005 until it inevitably zeroes out? It's admittedly a small bag, but I'm still holding it...

I don't know which stonk you are talking about - but IMO it is likely not going anywhere if it is trading millions (billioins) of shares at 5% of 1¢

-

1 hour ago, closetohumping said:

Market is crushing

becuase I got nervous and bought some puts last week - both short and medium term, because I hate making money on my investments

-

1

1

-

-

10 hours ago, 52-80 said:

I flipped out of my Tesla position for AMD last Friday.

Today news broke that TSLA is getting added to the S&P and it popped 13% after hours. Gayyyyy

#surlystonklife

-

2 hours ago, Hate said:

Yeah, but if there are fans then BDC likely finds that ball just off the fairway.First - there are never fans at The Masters, they are called patrons

Second - Maybe but the fans at ANGC are more typically around the greens and not lining the fairways; especially #11 where Dr DeChambeau favored the left side.

Then again the gift shop might have to start selling yellow hard hats with a green flag to the patrons for protection from his wayward shots -

On 11/15/2020 at 8:07 AM, Horn80 said:

, what exactly do you do here Harbaugh?

On 11/15/2020 at 10:15 AM, 6th Street said:Crazy because his offense with Kap was actually pretty innovative. Got the Niners to 1 Super Bowl and 2 NFC championships. Now they look like an old RC Slocum coaches team

On 11/15/2020 at 1:56 PM, 6th Street said:UM needs to hire Gary Patterson

Y'all need to shut the fuck up - or I'm going to have to rally the rest of the B1G in a huge "Save Jimmy" campaign.

Nobody wants to see him go (except Maize & Blue fans) -

- Popular Post

- Popular Post

45 minutes ago, Xian said:Urban to LSU?

you spelled Briles incorrectly

-

4

4

-

3

3

-

4

4

-

1

1

-

Well that pretty much wraps up the exciting part of the golf year - hoping 2021 keeps a full schedule & fans can get back to going to the events.

Michigan @ Rutgers (We're here for the lulz) BTN

in Football

Posted

It is not funny

because

it is hilarious

(don't worry bogey, I'm sure the next coach will be the right one)