-

Posts

7533 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Posts posted by Wally Fairway

-

-

Wally's MAC play of the day - Toledo/Western 59.5

Go scoreboard!!! -

Right now I should be watching old guys hit tee shots on a bunch of par 3's, and kids putting on the last green.

-

1

1

-

-

Ackman is trying it again (he bet against the market in February and says he turned $27 million into $2.6 billion in March)

https://www.ft.com/content/9697c211-c631-49b6-a91e-ae290fb02c3a

QuoteAckman places new bet against corporate credit Billionaire says markets are once again complacent about the impact of pandemic

Pershing Square founder Bill Ackman made $2.6bn in March from a wager that markets were underestimating coronavirus risks © REUTERS

Bill Ackman has put on another bet that companies will struggle to pay their debts, just eight months after he cashed in a $2.6bn profit from a similar trade at the start of the pandemic. The founder of Pershing Square told attendees at the Financial Times’ Dealmakers conference on Tuesday that markets had once again become too complacent about the coronavirus.

At the start of this week he put on a new trade hedging his equity exposure with insurance against corporate defaults, he said.

“I hope we lose money on this next hedge,” Mr Ackman said. “We’re in a treacherous time generally and what’s fascinating is the same bet we put on eight months ago is available on the same terms as if there had never been a fire and on the probability that the world is going to be fine.”

He said the new hedge is close to 30 per cent the size of the bet he placed in late February, when he bought a set of huge insurance policies linked to $71bn of corporate debt.

The billionaire investor anticipated governments would be forced to shut large swaths of their economies in order to curb the spread of coronavirus, leaving many indebted companies exposed. When that swiftly proved accurate, the value of the insurance ballooned and Pershing Square exited the trade in mid-March, pocketing $2.6bn in profits after having only paid $27m in premiums.

Mr Ackman chose to plough the winnings back into equities, adding to several of Pershing Square’s existing stakes and acquiring new positions that set the company up to profit from a stock market rally.

Pershing is up 44 per cent, year to date, having been down 7 per cent before the successful bet. Mr Ackman said he remained optimistic about the economy over the long term, saying that it was likely to see a “robust recovery”, but he predicted the next few months would be “a challenging time”.

Pershing Square placed its new bet against corporate credit on the day that Pfizer and BioNTech released positive trial data on their Covid-19 vaccine, causing markets to take a sudden bullish turn. The news was “actually bearish for the next few months,” however, Mr Ackman said, because it was likely to make people more complacent about wearing masks and less likely to view the virus as a threat. -

10 hours ago, Dr. Beeper said:

No question. Troxclair despises her. It’s evident in her lack of support. Troxclair is everything FatLump is not - hot and smart and not in the run-off

FIFY

-

3 hours ago, Pasken said:

you monsters.

I couldn't help but respond to Chip

-

2

2

-

-

37 minutes ago, shadow_operative2.0 said:

Quick 7-0 for Ohio in 3 minutes.

My kinda game, I'm on the over for Kent St/Bowling Green tonite and Toledo/Western tommorrow.

The race to 60 points is on-

1

1

-

-

MAC week 2 - half tonite, half tomorrw

-

1

1

-

-

On 11/8/2020 at 11:59 PM, Gil Bang said:

Ok, that's arms legs, finger and toes. His cock and balls are OK too, I assume?

no idea, I'll ask him an anonymous internet dude is worried about his junk

-

On 11/8/2020 at 11:55 PM, Gil Bang said:

So, my son left Ft. Jackson (where he was a drill sergeant) last month. He's now in Warrant Officer school, and then, it's aviation, where he'll become a pilot. It's super cool, except that he'll be in Alabama for a few years.

Anyway, his unit back at Ft. Jackson just had a young recruit die on the firing range. I'm so sad for the family, and I'm glad that my kid wasn't there at the time, because an 18 year old dying on your watch is bad for the CV. And also, I'm thinking although I know nothing about what happened, "my kid wouldn't have let it happen". Fuck me.

Y'all join me in pouring one out for Pvt. James Noel Zamora, an 18 year old from CA.

What a fucking tragedy.

That is a tragedy, I'm kind of amazed it doesn't happen more often as lots of those kids haven't been around firearms at all (or very much); my kid told me a story about a kid in his class that was trying to sneak ammo from the range to the barracks in his boots. Someone saw it, and told the Drill Sgt; the story goes the kid was sent to counselling and was going to restart boot with another group. Nobody as disappointed he wasn't put back into the ranks.

-

45 years ago today - you know about it from the song

https://noaa.maps.arcgis.com/apps/MapSeries/index.html?appid=858309daa74f4e6ebf81f32d128f7ed8

-

1

1

-

-

6 hours ago, TonyTexas said:

According to Carl Paulson, co-host of “Inside the Ropes” on SiriusXm PGA Tour Radio, DeChambeau teed it up last week with Sandy Lyle, the 1988 Masters champion, and the reports from Lyle were “jaw-dropping.”

Here’s a recap, per Paulson via Lyle, of what DeChambeau hit into some of the holes:

No. 1 (Par 4, 445 yards): Sand wedge

No. 2 (Par 5, 575 yards): 8-iron

No. 3 (Par 4, 350 yards): Flew the green with 3-wood off the tee

No. 8 (Par 5, 570 yards): 7-iron

No. 9 (Par 4, 460 yards): Sand wedge

No. 10 (Par 4, 495 yards): Pitching wedge

No. 11 (Par 4, 505 yards): 9-iron

No. 13 (Par 5, 510 yards): 7-iron (hit 3-wood off tee)

No. 15 (Par 5, 530 yards): 9-iron

No. 17 (Par 4, 440 yards): Sand wedge

The very definitions of bomb and gouge, except at The Masters there is no gouge

-

3 hours ago, ChiTownDoc said:

Oh yes. All that oil I was sitting on collecting fat dividends and waiting? Hahaha

Im a R but the markets want calm and stimulus right now. Joe B is a good thing. And Senate will stay R or be split. Perfect set up for a massive run gents.

So watch everything go to shit in the near future.

Good thing my SPY puts didn't clear on Friday, but my COST call are taking a beating today (slightly offset my BRKB calls and a small position with F calls)

I was looking at SPY straddles, but that shit has gotten really expensive

-

1

1

-

-

7 minutes ago, Anastasis said:

LOL Chuck Schwab is not processing my trades.

Reminds me of Black Monday, not knowing where individual stock prices are - except that was to the downside

-

Boom goes the dynamite

-

1

1

-

-

It's back, or at least being scheduled for passenger flights in the near future

I'd add a poll if I could

Would you fly out, in the next year?

Y/N?

-

1 hour ago, redswingline said:

I remember when he was at Stanford, Harbaugh slammed Michigan's academics (as related to degrees that Michigan football players seek). Something along the lines of "they don't have a general studies degree at Stanford", and "You want these kids to have a quality degree for life after football".

I assume he hasn't pushed for more stringent academics since he went back to Michigan.

He was pushing for Michigan to do it when he originally made that statement. No idea if he pushed for it once it affected his players at Michigan.

-

7 minutes ago, MonkeyDoughnut said:

Damn... Can't decide if that's a sign someone shouldn't get a new heart or a sign nothing going to stop someone from getting a new heart

in all honesty it was damn near a heartbreaking story

-

1

1

-

1

1

-

4

4

-

-

-

7 hours ago, Hefeweizen said:

There is no alternative.

Precious metals, cybercurrency (aka shitcoins), frozen concentrate orange juice, etc

-

1 hour ago, utee94 said:

I don't know what this one means, I'm assuming it's an inside joke I missed out on. Is it angry? Happy? Does it show up positive or negative?

Or does the name say it all, and you don't know until you fuck around and find out?

must have to be in the TreeFiddy club to fuck around

-

go home ETA, you're drunk.....and not looking at both the Keys and then maybe the Panhandle

-

2

2

-

-

5 hours ago, RPM said:

Someone should call and tell him to charge his phone.

just text Roman that number and say it's someone that will let him have both tacos

-

2

2

-

1

1

-

-

18 hours ago, UTexasFight said:

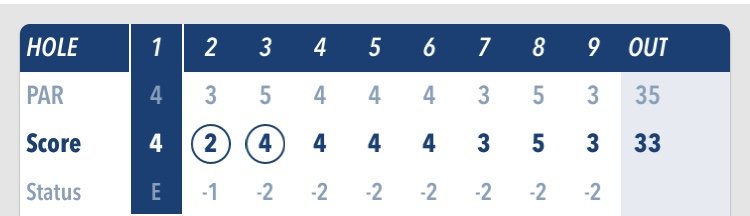

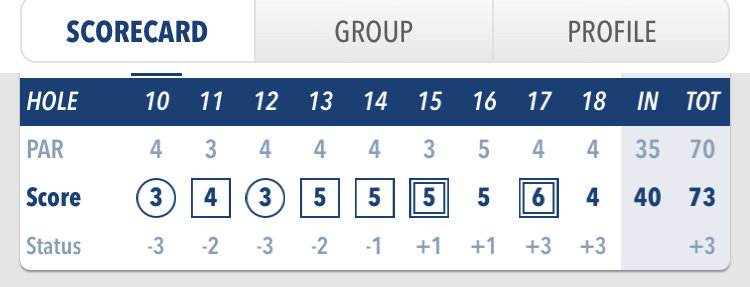

Yeah, I was surprised (but not shocked) as he was 1 shot out of the lead after the front 9 (maybe tied after #10) and then fell to 73 by the end of the day, and he will likely need to be 70 or better to play the weekend at Memorial Park

For what it's worth, I'm likely to blame for his performance as I put him on my fantasy team this week - for the first time in over a year.

-

I just saw this earnings report, and I'm amazed

QuoteYeti Inc. YETI, +16.51% shares soared 16.5% in Thursday trading after the cooler and outdoor drinkware company reported earnings that beat expectations and said sales exceeded $1 billion over a one-year period

That must mean that Yeti sold at least 1,000 of their coolers at $1million each

-

1

1

-

2

2

-

Major MACtion Mania

in Football

Posted

1 at TD at 9:18, getting on that point-a-minute place I need