-

Posts

74 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Everything posted by Jackson P. Neighbors

-

We were there as well, and frankly musicianship-wise, that was one of the better shows I've seen in years. I like their music, not omg love it, but I was legitimately blown away by Katie and yes, the steel guitar. They have a tight, tight sound in person. First time at Tannehills also and it is a cool little venue, would go back. And I know the whole area is touristy crap, but even my Ribeye at Cattleman's beforehand was pretty good.

-

You are not the first to confuse banking and defecation.

-

Tiny $55M bond bank, 35% LTD, negative TE bcs of portfolio duration, weak NIM of course, sold securities in 3Q which resulted in their Q loss. Actual leverage capital $5.5M, 8.4%, not terrible, not great. "Well Capitalized" per PCA. Management paid themselves very healthy dividends at YE 2022 so this seems to be FRB telling them "Not this year." Unless there is something fraudulent going on, this is not a failure candidate. Probably great-grandaddy's heirs run it and just collect a decent paycheck. Anecdotally, I hear that all regulators post-March now will issue public actions for repeat matters instead of the prior practice of keeping them non-public (MRA/MRBA) from exam cycle to cycle. This means you'll see more of these. Also, I recommend signing up for the enforcement action email distribution lists from FRB/OCC/FDIC for a little laugh on occasion. You'd think that all little ol lady bank tellers 65+ are just defalcating left and right.

-

We did Breckenridge this past summer with three other families and kids ranging from 7-teens. For what you are looking to do, it would fit the bill. One day do rafting on the Arkansas then boom, you are setup for lunch / exploring Buena Vista and you can stop through Leadville also on way back to Breck. One day do the Vail pass on bikes, opt for a bike pickup location in Frisco, and boom another cool town to spend the day at. Then head to Lake Dillon which is right there and fish on a pontoon. Easy peasy. Another day can be downtown Breck exploring, hitting up the brewery and distillery etc. There are too many hiking places to list but you have no shortage. The town itself is small, like 5x12 mini blocks. It was definitely crowded but parking a few blocks off the main street and it's no problem. One big but obvious piece of advice is research what excursions you are wanting to do and get a reservation for EVERYTHING. Book guides for rafting, bikes, and fishing weeks in advance. Lunches and dinners, at least in Breck and probably Frisco too. You can do tennis/pickeball in your downtime at the rec center very nearby but again, make a reservation. HTH, good luck.

-

EF-1 tornado and thunderstorm system ripped a line from Greenville through the area well into Louisiana late Thursday/early Friday. Caught many high-voltage transmission lines and a bunch of collateral tree damage. When I drove in, I was surprised at the lack of obvious damage from branches down, I think it's more the major lines were severed. Things seem to be getting repaired at an increasing pace today. No consolation for those directly impacted, obviously. This is a poorer area of TX so if I hear of legitimate places to donate $$, I'll follow up.

-

Very weird coincidence, but in the span of typing my initial msg to you, the outage map updated and voila - our area now has power! Uncle called their neighbor and sure enough, just freaking came back on. Power of Surly at hand?...... Hope your folks experience something similar. For reference, we all are near Mt. Vernon.

-

I don't know much about how disaster declarations are handled vis a vis the county and state levels, but I have read that several county judges have declared county-level disasters and the orders definitely mentioned price gouging. Aunt and uncle looked up the local POS motel 8 and online price said $380, they called and person said they actually didn't have any rooms.

-

We've got a place out in ETX, all cameras are wifi so I knew power was out of course. No big deal, it happens not infrequently. Woke up Friday and checked the outage map for SWEPCO, my provider, and HOLY SHIT. Carnage from Fayetteville down to near Alexandria. 240k customers out. Every fucking customer in Franklin County was shown to be out. 100%, the entire county was and is, still down. Amazing. After a couple of hours, I got what, in retrospect, might be the world's most wildly inaccurate email from them saying estimated restoration was Saturday at 3PM. I decided to go out there Sat morning to clear the fridges and freezers and try to salvage anything I could before it rotted. Saturday morning wasn't really even bad in the shade and I could still only take about 10 minutes inside at a time before having to get back outside in the breeze, drenched in sweat. 3PM comes and goes of course without restoration. Then about 6PM I get another email saying my estimated restoration time had been moved back just a tad to NEXT FRIDAY BY 10PM. Called aunt and uncle who are also out there nearby and told them to get their old asses to Dallas ASAP, shit was borked. They arrived safely yesterday afternoon thank god but said it is very bad, everyone is crowding into the local Dukes or a random church, or Walmart, or the school gyms, anywhere there is a generator and AC. There are literally thousands of line workers coming in from across the country to help, its going to really suck for them. I am also very surprised this isn't a bigger news story outside of that local area. The medium-size towns like Longview, Tyler, etc. are also in a world of hurt. If you have a bunch of free time, here's the current outage map, updated every 15 mins: SWEPCO Outage Map Good news, down to 110,000 out right now...

-

Damn. My dad was a USN man but had a lot of respect for civilian seafarers. He would play WOTEF as often as possible every Nov. 10. His baritone is not heard much anymore and the storytelling is uniquely pure and tragic. Godspeed.

-

.thumb.jpg.311f9c239e3cdc4d129a490ae4661d4b.jpg)

What’s your favorite completely fucked up movie?

Jackson P. Neighbors replied to tbone_'s topic in Movies and TV

-

Guess we'll just keep this rolling in this thread. Not to be outdone by their FRB rivals, the FDIC's Signature Bank report: https://www.fdic.gov/news/press-releases/2023/pr23033a.pdf released an hour or 2 ago. Eagerly awaiting the email from FDIC in a couple hours stating "...XYZ Bank agreed to assume all of the deposits of First Republic Bank..."

-

It reads like ALCO was in place, they simply botched the call of where rates were going. Amazing. I'm going to get tinfoiley-hatty now (and that's not ever me), but this report just makes things seem too coincidental. 90% of it is non-public information, except when something like this happens. Report references forthcoming regulatory actions including multiple MOUs and MRBAs which are never publicly disclosed. CAMELS ratings and exam reports are very confidential. The 4Q financial numbers weren't significantly different from other recent quarters, so there was no obvious reason for a depositor to panic, especially so late in 1Q. But if this information were to be disclosed by someone either from the bank or regulatory side (FRB says no ethics violations in regulation have been discovered) to say, a very large and influential depositor, it could possibly result in some anxiety and, say, $40B in withdrawals in one day and $100B expected the following day...

-

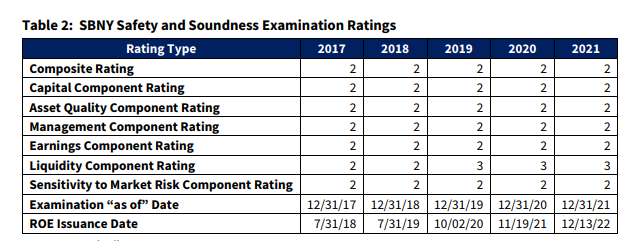

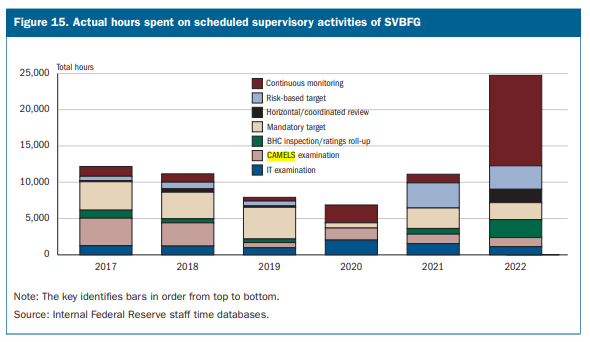

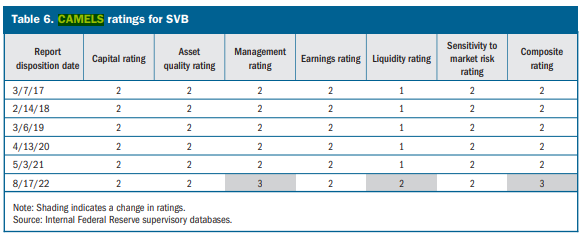

First chart shows ~12,500 man-hours devoted to "Continuous Monitoring" during 2022. Basically, FRB had examiners onsite at the bank for over a year, getting all the reports that management gets in real time. Yet... regulation was ineffective. As others said, second chart shows CAMELS ratings resulting from in-depth regulatory examinations, the latest began in August 2022. After the exam, Liquidity and Sensitivity components (which were the drivers of failure ultimately) were rated 2- Satisfactory. Management was rated 3- Less than Satisfactory. The overall composite rating was also 3 which was a downgrade from the 2021 exam. To sum up, when Management is rated 3 but all other components are rated 2 and the overall rating is 3, it means "We don't really like what you guys are up to, but we have no fucking clue how to fix it."

-

-

Post-mortem report by FRB just released: https://www.federalreserve.gov/newsevents/pressreleases/bcreg20230428a.htm "Before discussing specific supervisory and regulatory changes that we should consider, I would like to touch on broader issues exposed by the failure of the bank. First, the combination of social media, a highly networked and concentrated depositor base, and technology may have fundamentally changed the speed of bank runs. Social media enabled depositors to instantly spread concerns about a bank run, and technology enabled immediate withdrawals of funding." Just wanted to post the link for everyone. I haven't read through anything but the introductory comments by Barr.

-

.thumb.jpg.311f9c239e3cdc4d129a490ae4661d4b.jpg)

All Encompassing Mortgage and Real Estate Thread

Jackson P. Neighbors replied to UTPhil2006's topic in Business and Markets

I think that's considered Bluffview. $2-10M homes abound. Younger than Preston Hollow, generational wealth, folks choose private school versus going into HP/UP. Keep going north across NW Hwy and you get into the honey pot. Or stay on Lovers and eat at Celebration or Jose. Can't lose but take your statin if you do Celebration. -

Confusing post, and you seem triggered by this situation. Good luck!

-

For Release WASHINGTON – The Federal Deposit Insurance Corporation (FDIC) entered into a purchase and assumption agreement for all deposits and loans of Silicon Valley Bridge Bank, National Association, by First–Citizens Bank & Trust Company, Raleigh, North Carolina. The 17 former branches of Silicon Valley Bridge Bank, National Association, will open as First–Citizens Bank & Trust Company on Monday, March 27, 2023. Customers of Silicon Valley Bridge Bank, National Association, should continue to use their current branch until they receive notice from First–Citizens Bank & Trust Company that systems conversions have been completed to allow full–service banking at all of its other branch locations. Depositors of Silicon Valley Bridge Bank, National Association, will automatically become depositors of First–Citizens Bank & Trust Company. All deposits assumed by First–Citizens Bank & Trust Company will continue to be insured by the FDIC up to the insurance limit. As of March 10, 2023, Silicon Valley Bridge Bank, National Association, had approximately $167 billion in total assets and about $119 billion in total deposits. Today's transaction included the purchase of about $72 billion of Silicon Valley Bridge Bank, National Association's assets at a discount of $16.5 billion. Approximately $90 billion in securities and other assets will remain in the receivership for disposition by the FDIC. In addition, the FDIC received equity appreciation rights in First Citizens BancShares, Inc., Raleigh, North Carolina, common stock with a potential value of up to $500 million. The FDIC and First–Citizens Bank & Trust Company entered into a loss–share transaction on the commercial loans it purchased of the former Silicon Valley Bridge Bank, National Association. The FDIC as receiver and First–Citizens Bank & Trust Company will share in the losses and potential recoveries on the loans covered by the loss–share agreement. The loss–share transaction is projected to maximize recoveries on the assets by keeping them in the private sector. The transaction is also expected to minimize disruptions for loan customers. In addition, First–Citizens Bank & Trust Company will assume all loan–related Qualified Financial Contracts. The FDIC estimates the cost of the failure of Silicon Valley Bank to its Deposit Insurance Fund (DIF) to be approximately $20 billion. The exact cost will be determined when the FDIC terminates the receivership. The FDIC created Silicon Valley Bridge Bank, National Association, following the closure of Silicon Valley Bank by the California Department of Financial Protection and Innovation. All of the deposits—both insured and uninsured—and substantially all assets and all Qualified Financial Contracts of Silicon Valley Bank were transferred to the bridge bank. The purpose of establishing Silicon Valley Bridge Bank, National Association, was to allow time for the FDIC to stabilize the institution and market the franchise. Don't know much about the acquirer other than news reports that they're the 3rd largest buyer of failed depositories since the 08 crisis, so I suppose they know how to handle assets of a failed bank.

-

Ol' Johnny-on-the-spot Moody's with a timely warning - everyone panic! Pretty rich considering that they had SVB's LT debt at A3 for years right up until it blew up and only then did it go to Baa3 to C to WR within 3 days.

-

Absolutely. Plus, article states FHLB offered a smaller amount which was refused, so they could have funded some, but not all $20B. Also, those FHLBs aren't required to make a loan if its not safe - the fact that it was offered tells me the theory that fed/fhlb wanted to cut them off is maybe far-fetched.

-

How was SVB saved? It failed, went into receivership, and the FDIC still can't find a buyer(s) for the assets. The shareholders and at least one class of bondholders have been largely wiped out. The only group that was saved were depositors by the temporary deposit limit increase, which also applies to FRB depositors.

-

Gosh, I didn't know I ever made a statement that the bank wasn't properly risked. My only posts were related to the reason that regulators took it to receivership, which has nothing to do with funding mismatch. My first post on the thread clearly identified deposit concentration risk as the biggest problem once all things were considered. What do you see as the reason regulators took it to receivership at 9:30AM time on the west coast? Risk management practices?

-

Sir, I have never worked one minute of my life for a bank and I would not associate with anyone who had.

-

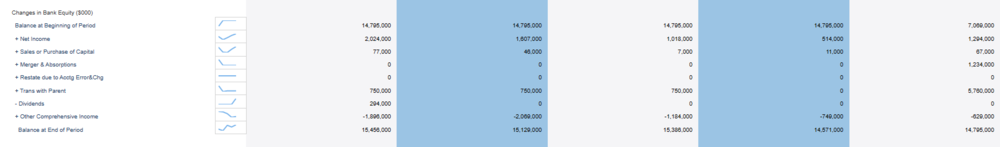

You have a good high-level grasp of the issues at hand, and I concur with many of your points. However, I do not agree that any sort of mark to market recognition of AOCI losses would have averted this situation. As I said, all of the exposure is very clearly identified in call report data: You can even see that AOCI _increased_ in the 4Q as interest rate increases moderated. Most recent Q is on the left. I also previously posted that SVB is not even in the top 100 banks nationwide for AOCI/Total Deposit ratio. Its not even close. Mickey mouse mark to market accounting had zero to do with this failure. Not excusing dumb investment decisions at all but that is not what caused this failure. A $42B run in one day will ruin any institution over $250B and subject to all the "enhanced regulatory" screening out there. Again, you seem to have a nice hold on the subject at hand, and I enjoy the discussion and am very interested in both giving and receiving knowledge about this disaster. But don't tell me that anything I am typing about is categorically untrue.

-

What multiple bank failures are you referring to? Signature and....? What CAMELS component(s) was most deficient in the SVB and SB failure? What was the regulatory trigger than took them down? Capital? Nonaccrual loans? Looking for actual analysis rather than cursory high level talk.

Football ... Basketball ... Baseball ... Other Sports ... Futbol ... 🤫995🤫 ... Gambling ... Movies & TV ... Music ... Hobbies ... Lulz ... Food & Travel ... Daily Texan ... Business and Markets ... Cloak Room ... Help ... For Sale ... Board Discussion ... Subscribe!... Donate!... Advertise... COOKIE MONSTER!

.jpg.cc1ebc38f1f8d9a15f5be2e665fd6865.jpg)