Comparing the mortgage interest deduction and the proposed $25K down payment support is silly since they operate in very different ways (who it directly benefits, how much they benefit, and when)

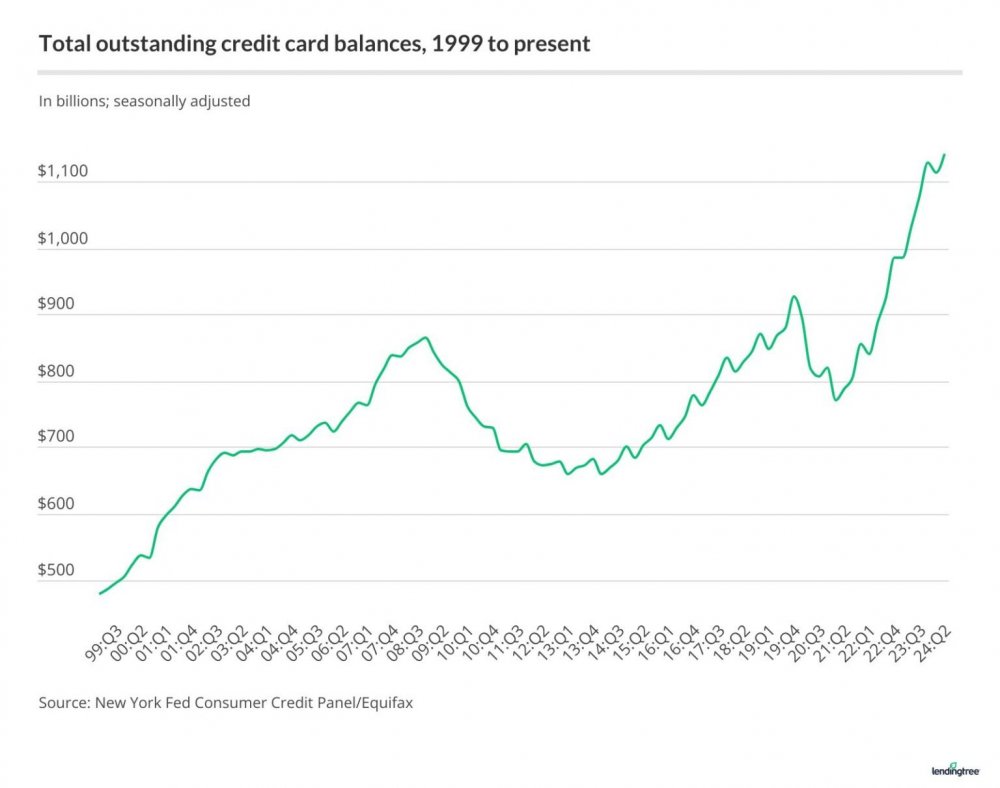

It's a very simple way to increase the cost of homes by another $10K - $25K while also adding to our deficit. It's the same problem with paying off people's student loans - it just incentivizes universities to charge more and exacerbates the issue. At a higher level, I hate it because it's pandering for votes with tax dollars, which, to be fair, is equally dumb when Trump (and I guess Kamala now too?) offer handouts for child tax credits and not taxing tips. Every single fuckstick running for office, except probably RFKjr, seem to have no issue with spending us into oblivion.

I shouldn't be surprised that voters fall for this shit every cycle though, much of the voting population consists of dumb selfish idiots that can't manage a lemonade stand, much less a budget or understand basic economics.