Everything posted by Vegas64

-

Things not going well in Venezuela

So rumors are that Rodriguez the Maduro VP whose Venezuelan high courts just swore in, was the one who was as the inside mole to the US and ratted him out. Funny if that is proven true over time. Best-case scenario might be a Noriega 2.0, when Panama’s genuine democratic transition soon superseded initial condemnation of Bush's intervention. Worst-case scenario could be a Gaddafi 2.0, though Venezuela doesn’t face anywhere near the same ethno-political fractures and separatism that Gaddafi’s regime papered over in Libya.

-

Greenland

If you take about 10 steps back, I’m seeing a picture emerge. I don’t want to overstep and leap into conspiracy land, but the political madness lately does make sense if you consider the following: The incoming AI and automation doomsday for labor (blue collar, white collar, and minimum wage), will necessitate a social framework that will need to keep the billionaires happy AND the rest of us from the streets with pitchforks. If you look at, say Norway or the Middle East, a great way to accomplish this in the short run is a dividend paid to American citizens akin to a UBI check for most of us, the “useless eaters”, to meet basic needs (or at least feel like we are). In order for this economic framework to work, you need a) strong returning assets like oil (see: KSA) like we look to be adding with Venezuela and Greenland b) strict/tight definitions, laws and parameters on what an American citizen is and means and qualifies for the monthly stipend. Which is why nationalism is all the rage again versus open borders etc. Basically capitalism has failed and we have no exit ramp now that AI has been captured by the elite.

-

Things not going well in Venezuela

Checks out. The last straw was the ego gut shot.

-

Things not going well in Venezuela

It sounds to me like we (The US) just got impatient and sick of waiting. We've been in some form of negoitating Maduro's exit for 6 months+ from stepping down to an actual exile (Russia/Belarus) and my first thought is that the US got tired of waiting and got the sense that Maduro was stalling and kept changing his mind in a way that signaled he was never going to actually step down and he's just stalling like a hostage crisis who is just buying time for someone to bail him out.

-

Things not going well in Venezuela

- Dallas - Even Shittier than Normal

Why would you be surprised? Dallas is heavy with narcos.- Robinhood Prediction Market

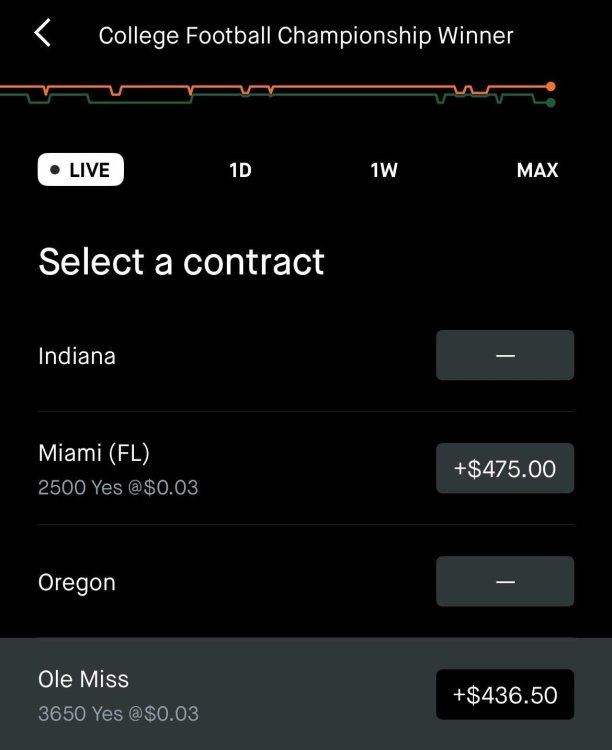

What would y'all do to maximize or optimize the end state here considering a) the two long shot bets I have are already in the money and b) they play each other next week so only one will pay out if I let it ride? ETA: I paid about $185 for the two positions and they are up ~$900 right now.- Looksmaxxing: Body Dysmorphia For Men! Now Featuring Meth, Smashing One's Own Face With A Hammer, and Intentionally Driving Your Cybertruck Over Another Person

I don't think so. I went down a rabbit hole on this stuff and apparently there are penis enlarging techniquest to lookmax and make it huge and exercises and messageboards about it.- Everything sucks now remember when things were better: Malcolm in the Middle

Glad to see Colt McCoy having an interesting and creative second act after football!- New Site Software / Theme

Am I missing something on not being able to log in to my normal account? I can't find what burner email address I used and when I click the settings it demands to be logged in first to view. Being out on holiday before the cutover did I miss my chance and have to create a new handle?- I for one welcome our new AI overlords

This. This is exactly what a sane and rational response sounds like when you are actually intellectually curious and open-minded, while simultaneously being put off and disgusted with the present bubble. Find use cases that make financial sense and actually help people and society in a variety of ways.- I for one welcome our new AI overlords

What are you offended by here exactly? That there is a *gasp* positive aspect to something that you want to mortally hate? I’m not an AI bull at all, but it IS interesting and there is a silver lining of a cool application for AI as Waymo absolutely uses LLMs and Google’s entire deep mind/brain/gemini gen AI expertise to train and run their models that power self driving. Waymo (and fully self driving generally) is 100% an AI use case.- I for one welcome our new AI overlords

For all the fun we have about how there aren’t any real or good applications of AI and it’s all fugazi, I was listening to something that startled me. self-driving à la Waymo is a slam dunk grand slam AI story from every angle you look. Self driving only took off after all the neural AI discoveries and advancements of LiDAR and sensors to feed data for foundational models to process. Most of us are familiar because we live or spend significant time in Austin (or SF), but as it starts to roll out nationally and globally the world will appreciate it. - CDC statistics cite over 40k deaths in USA a year or 120 a day due to vehicle crashes operated by people. - adjusted for city street driving, apples to apples, Waymo is 91% safer then people driving . You can understand why if you’ve driven the last 10 years with the advent of the smartphone and the epidemic of distracted driving. Heck someone on one of the AI threads posted while driving on CarPlay. - and this isnt just a small data set. Waymo has millions of miles driven. - 91% reduction in accidents is a massive cash savings. CDC put out a report on Medical costs and cost estimates of lives lost is $470bn a year (2022). 91% reduction and reducing crashes 10x is $420bn a year. That is nuts. - It was relatively cheap for an AI investment too. 15bn investment to get this to this point. $15bn is a fraction of what foundational AGI models have burned. $15bn is 1 year of Ubers profits. It’s 1 month of Google profits.- The Lost Generation essay

There is a reason people who look and talk and live like me are enjoying Mamdani in NYC.- The Lost Generation essay

I think the argument is that for some of these aggrieved white males, sure, they are lost to the other side making promisses, etc. But there are some who can be reasoned with and who can come around from the initial bloody nose with a little empathy and pep talk, who can be saved from the dark side. You seem to think there is not a messy middle ground where perhaps slighted people can feel safe in calling out a wound, maybe feeling sorry for themselves for a minute or two, but then taking a step back and weighing everything out on the balance and making a decision to move forward as non (or less) aggrieved. You seem to think all these white guys who carp about the changes they are facing are either all lost causes or actually have no right to those feelings. At least that's what it seems like based on your responses.- The Lost Generation essay

That was unintentionally funny, too, but the main call out there was showing the author, in his own words, is trying to say he and his ilk are still liberals.- The Lost Generation essay

I think the argument is, much like it does in your whole professional career, it helps people to get onboard with the new reality. Whereas if you were to take a more antagonstic tone of the just deal with it and glossing over the personal impact with a lack of implied care or empathy, it invites conflict. The point is to minimize conflict.- The Lost Generation essay

Reminds me so much of this lol Preach.- The Lost Generation essay

Have you never had to deliver tought news to someone, a child, an employee, a player, that was coming from above you? Maybe you didn't completely agree with it or maybe you could see from their perspective how it wasn't fair and there was some tough breaks and bad news, but that decisions and strategy was set and the direction was final? I think that's the posture he's saying to take. Acknowledge/address that the situation sucks for them and have some empathy but, like, there's not a lot we can do about it and it ain't going back the way it was. We can take 15 minutes to mourn it but we have to move on and build a bridge and get over it. Or as Bezos famously said, "disagree and commit".- The Lost Generation essay

- I for one welcome our new AI overlords

https://thisecommercelife.com/blogs/comics/the-story-of-ai- I for one welcome our new AI overlords

Back to AI and the bubble, read this and though it appropriate and directionally correct:- I for one welcome our new AI overlords

While not that extreme and I joke, but I have become definitely more progressive on certain things in my old age. Namely marijuana legalization is 100% a no-brainer and billionaires and late stage capitalism is a scourge. I'm an agrieved middle class guy who is seeing the light that we are being squeezed and wrung out. "bled of every dollar and left an empty husk" as you so eloquently stated. It's we (99%) who have the leverage and grievances. It's they (1%) who should be changing for us. Fitting that today is Festivus, I guess.- The Trump Economy

Isn't this the screaming red flag of a capital K, K-shaped economy?- The Lost Generation essay

- Dallas - Even Shittier than Normal

Football ...

Basketball ...

Baseball ...

Other Sports ...

Futbol ...

🤫995🤫 ...

Gambling ...

Movies & TV ...

Music ...

Hobbies ...

Lulz ...

Food & Travel

...

Daily Texan ...

Business & Markets ...

Cloak Room ...

Help ...

For Sale ...

Board Discussion ...

Advertise...

Tailgate Donations

Back to top

Account

Navigation

Search

Configure browser push notifications

Chrome (Android)

- Tap the lock icon next to the address bar.

- Tap Permissions → Notifications.

- Adjust your preference.

Chrome (Desktop)

- Click the padlock icon in the address bar.

- Select Site settings.

- Find Notifications and adjust your preference.

Safari (iOS 16.4+)

- Ensure the site is installed via Add to Home Screen.

- Open Settings App → Notifications.

- Find your app name and adjust your preference.

Safari (macOS)

- Go to Safari → Preferences.

- Click the Websites tab.

- Select Notifications in the sidebar.

- Find this website and adjust your preference.

Edge (Android)

- Tap the lock icon next to the address bar.

- Tap Permissions.

- Find Notifications and adjust your preference.

Edge (Desktop)

- Click the padlock icon in the address bar.

- Click Permissions for this site.

- Find Notifications and adjust your preference.

Firefox (Android)

- Go to Settings → Site permissions.

- Tap Notifications.

- Find this site in the list and adjust your preference.

Firefox (Desktop)

- Open Firefox Settings.

- Search for Notifications.

- Find this site in the list and adjust your preference.