Everything posted by RCRanger03

-

Penny stock thread split

Peter Chasey is David Lazar's lawyer... https://chaseylaw.com/attorney-profile/ Who are you looking at?

-

Penny stock thread split

Haha I've been on shaggy or surly since 2007, and I've worked with the chronically homeless for 6 years there's no need to hold anything back. I've gotten linked to the stupid shit my wife says thread more times than I can count. Sent from my SM-G970U using Tapatalk

-

Penny stock thread split

Anyone who got something on the amazon list PM your contact info, my wife at the very least wants to send you a thank you card. Some of those already started coming in and it's pretty cool of yall. I will say though that while I had a great time playing Catan it almost ended my marriage lol

-

Penny stock thread split

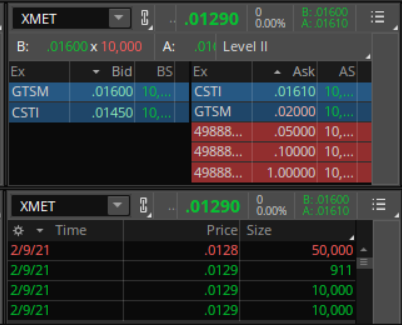

People trying to get in or add as low as possible on the BID, but also a general sentiment that it's going to go up so not undercutting the ASK. You'll see big gaps like that on runs, and recoveries from a big dip as people are trying to feel out which way the wind is blowing.

-

Penny stock thread split

Thank God for that

-

Penny stock thread split

Make sure you read up on Wash sale

-

Penny stock thread split

401ks, Institutional Buyers, Retail that can't buy OTC, ETFs could even pick it up. Cathie Wood who is shopping an Aerospace ETF gave a webinar yesterday that basically name dropped Vayu (fast delivering medications in Africa by drone) and there is noise that they'll get picked up there. I've never been a part of an OTC uplist that actually happened, so this is new territory for me though. My mind tells me to temper my expectations of what will happen to the PPS, but my heart tells me $20 by the end of the year.

-

Penny stock thread split

Didn't get to my sell on SNVP so I took it down. Will survey how things look tomorrow. It held up better than I expected when it lost the penny, even managed to regain it a few times. I'm still on the lookout to sell out of my position though. XMET is now more valuable than my TSNP position and approaching my ALPP position. Speaking of which, ALPP is doing perfectly what I wanted it to do this week. Churning Churning Churning until Nasdaq

-

Penny stock thread split

Made a little money on that shroomer, that and MEDH are the only two psychadelic/weedstocks I've not gotten absolutely demolished on. I'm steering clear until I can get a better handle on that sector

-

Penny stock thread split

These are the things that you learn from experience, I personally never sell into bid on a freefall. Even shit stocks get dead cat bounces. The problem I have is you can't sell 1M shares on the bounces. I think I'm going to hold today base. I'll sell into the ASK if there is a run later today or tomorrow. It's all free shares anyways, but I think I'm officially done with Suneel Sawant. Plus then I can get fully into the Roth deal. I'm dying watching candidates pass me by

-

Penny stock thread split

SNVP is at a very precarious position right now. I actually can't exit ATM, because I think it will tank the stock, but if you have a small position try to get out on the peaks above .01 it lost the momentum and as I've been saying nothing real is propping it up. Without news, I fear this will be in the mid .00s today or tomorrow. I know for sure it won't survive the Friday sell off. Just my .02

-

Penny stock thread split

It's the larger number. OTC Markets is usually the best place to look for that. It's very solid for this kind of play, but not above RM Did yall see that sell off on XMET when it touched .02 this next time it's going to blow through the GTC sells that are sitting there

-

Penny stock thread split

XMET officially my third holding to go over $100k with $5k or less initial investment this year. I think FPVD is next up. PFMS on deck

-

Penny stock thread split

Yes a little, there isn't much need. However even with that SS the last one they tried to merge PFMS with ZOOMOUT immediately filed an R/S with the name change and tanked the stock. I think that was a reason their deal with Lazar fell through.

-

Penny stock thread split

- Penny stock thread split

- Penny stock thread split

Yes please I've needed to do this for months, but haven't set aside the time.- Penny stock thread split

Yeah I was thinking the same, but just a hair lower due to them being a rising company and most of their staff including a lot of leadership seems pretty young. I don't know what competitive wages for that kind of work are in Singapore, but maybe @Coelenterate Fuccboi knows. Looking at the Samtrade business model page it does seem like their revs will grow exponentially with the expansion since they're driven by trading volume. An entry into the US market would be pretty huge.- Penny stock thread split

Oh shit I forgot you're in Singapore! You actually might be able to help aside from unlawful entry. How's your Chinese?- Penny stock thread split

Word of warning about iHub... it's like 90% chafe. There also is a class of posters that are roving bashers and have protection from the Site administration. I'm a moderator on the PFMS board and been told as much. It's useful for my purposes of posting rambling DD threads and crowdsourcing where to look for information. Also the 10% that is good can really be helpful in finding NEW things that haven't popped yet.- Penny stock thread split

Shell plays at this level are worth your wariness if you're not in low enough or not riding free shares. Take enough profit to feel like it was worth the time you spent on it and the once you are, my advice is to just let it run it's course with what's left. Doing so has put me at nearly 100k unrealized profits in XMET already without as much stress. SNVP still has me wary enough with lack of communication or developments that I think that is going to be what I take mostly out today to start my Roth with if gets back up near $0.02. I'll a couple hundred K shares just incase- Penny stock thread split

Yeah I keep pushing for financials and catch find em. I'd value their marketing alone the last year or two has been 250k - 500k, I've seen multiple donations of 40k or more. If charitable giving is 5% of revs and marketing is 15-20% very conservatively that puts them at ~$2M in revs. My hope is that it's more in the $7M - 10M range- Penny stock thread split

The first 30 mins of T Trades this morning has me expecting a cold open for ALPP, hopefully they do their typical 8:00am news PR this morning to counteract.- Penny stock thread split

That all looks about right. You're correct in that I am a big fan of shell plays. They're just about the only ones that go from triple 0 to a penny. If you like the direction you stay, if not then you take your profits and start over again. They just tend to take a while. I've been in SNVP since the summer 2020, FPVD, PFMS, and XMET since the fall. I wish I was in TSNP from before their R/M news, but I was a medium to latecomer on that one catcing it just after pennybreak because I was too distracted with other plays that ultimately didn't pan out (womp womp). That post penny break entry could be a similar period to what we're entering with PFMS Samtrade is a growing Forex trading platform that looks to be aggressively expanding outside of it's Asian market. Already has pushed into Australia and Europe. The CEO seems good. We just don't anything about their financials yet. I'm not on board like I was pretty quickly with TSNP, but with more information I could be persuaded to leave a legacy position. Still somewhat wary about a R/S given what the Swiss billionaires in QUTR/BRRN did to me. I had a similar sized position, which has now languished post R/S. All that to say I watching things closer here than I did there- Penny stock thread split

Posted some more PFMS / Samtrade DD https://investorshub.advfn.com/boards/read_msg.aspx?message_id=161680320 - Penny stock thread split

Football ...

Basketball ...

Baseball ...

Other Sports ...

Futbol ...

🤫995🤫 ...

Gambling ...

Movies & TV ...

Music ...

Hobbies ...

Lulz ...

Food & Travel

...

Daily Texan ...

Business & Markets ...

Cloak Room ...

Help ...

For Sale ...

Board Discussion ...

Advertise...

Tailgate Donations

Back to top