Everything posted by RCRanger03

-

Penny stock thread split

I've only pulled $20k out total (original investment last march was my stimulus $3400), the current unrealized gains are 4X my family's combined annual income. I don't know shit about taxes, I'm a poor 12% tax bracket non-profit worker. Anyone have a good tax man?

-

Penny stock thread split

Ugh I'm going to miss market open stuck in traffic on 35. What are yall seeing Sent from my SM-G970U using Tapatalk

-

Penny stock thread split

I had hoped it would hold .0015 or at least peak higher. I still don't trust it too much, tomorrow could be bloody if all the fomo flippers lose interest. I'm not on free shares anymore so if I can accomplish that tomorrow probably will. The thing that keeps in interesting is the low float and potential R/M Have been trying to exit some of these current tickers before I begin adding new ones, but they keep sucking me back in. If I get out of SNVP, MEDH, or BRRN I'll take a look. At one point last year I was spread thin on a ton of ticker and it wasn't as successful (less time to keep track of movement and DD, less initial capital investment)

-

Penny stock thread split

But but then I could buy more Stonks! Got held right at .005 the whole damn day, manipulation at it's finest. To be clear the reduction hasn't been announced just the motion to bar anyone from stopping that happened was granted, but I'm still betting on the reduction. I will likely sell some on that news no matter where it goes, because of the ever present danger of an R/S or going dark with Chinese buyer, but those can't come without termination of custodianship so watching for that on the court register or in NVSOS filings. Did anyone flip SNVP or did yall hold? I was hoping for more of a run on the volume that it got. This MEDH, PFMS, TSNP, and ALPP did nice work. Even with a $10k red anchor from XMET and FPVD, I had a 20k day and closed at my highest total yet. Have had a few higher peaks, but not a bad day.

-

Penny stock thread split

My wife told me to stop buying Lagavulin lol She also told me I should start a Patreon, anyone know anything about that?

-

Penny stock thread split

TSNP getting worked down now, could break back to mid to low .50s if .60 falls through. What you saw was nobody selling into the run, I feel like there is too much float to be locked, but who knows there is strong confidence in TSNP shareholders. Flippers broke the combo run .50 - .70, but I bet with big news (I'm think the Humblpay App launch in the US or ticker change) to actually trade on it will break $1.

-

Penny stock thread split

I mean I do regret not buying more ALPP right before it broke into dollarland... I burnt my powder on SNVP this morning. Good luck if you do, it's pretty ballsy to buy on this kind of run. I will say I do believe TSNP could be something generationally special. Bigger than what we've seen in ALPP. I'm sure as hell not selling

-

Penny stock thread split

Holy shit, TSNP just became a midcap in ThinkOrSwim, passing up ALPP. I think that means their Marketcap surpassed 2 Billion

-

Penny stock thread split

Like with ALPP one day it's just gonna go and never come back. I'll tear up and then wipe it away with 100 shares of TSNP before I light my cigar with it.

-

Penny stock thread split

Going into a meeting that I'm presenting at for the next few hours. Don't let anything tank. I'm counting on yall!

-

Penny stock thread split

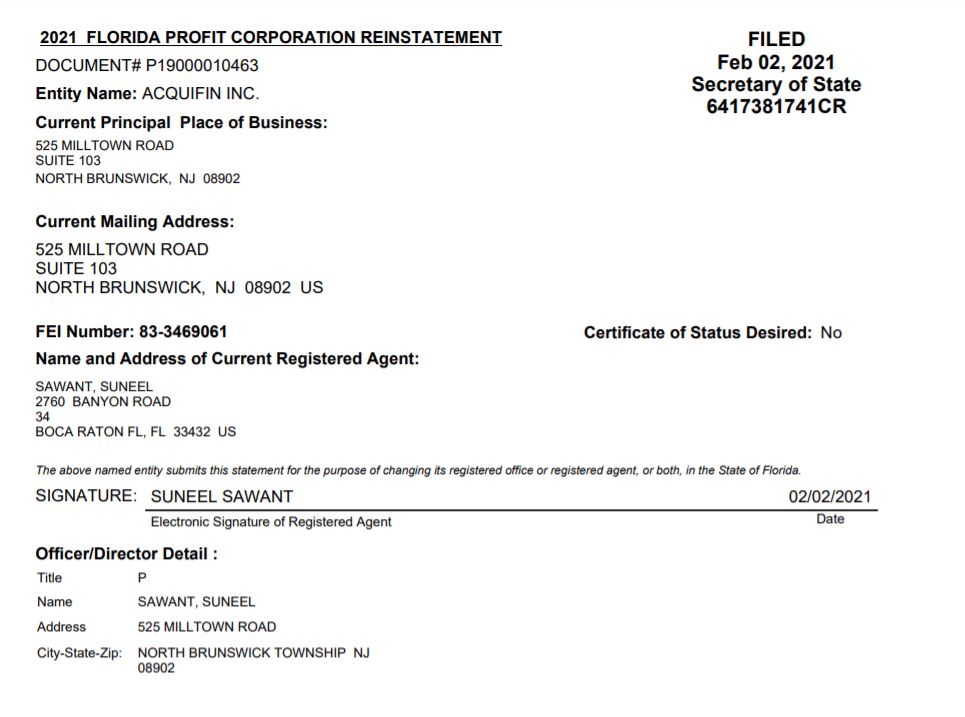

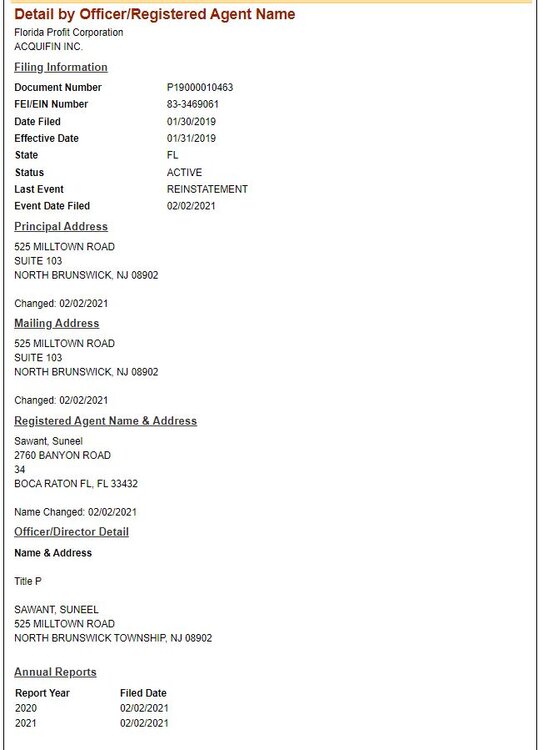

Thats tough depends on your risk profile... probably PFMS. Samtrade looks pretty amazing. We still don't know enough about SNVP and Sawant's goals and they've been less communicative. The reward is a lot better on SNVP right now though. 8-9x if you're willing to assume the risk. If you're low risk buy TSNP or ALPP

-

Penny stock thread split

SNVP I slapped the ASK didn't want to get caught out. I think I may have been able to get .0008s but it wasn't worth the $100 to be on the outside for me. FPVD I spoke to Lou Kerner (he's now following me on twitter which is cool) he said he's at fault for the 8k not coming out on time he started it last wednesday and apprently it just didn't get done. That's excellent candor and availability, which is second best to delivering on time haha. I really like Lou! He also shared the IR contact info who I've reached out to. Feel free to do so your self IR@bigtoken.com

-

Penny stock thread split

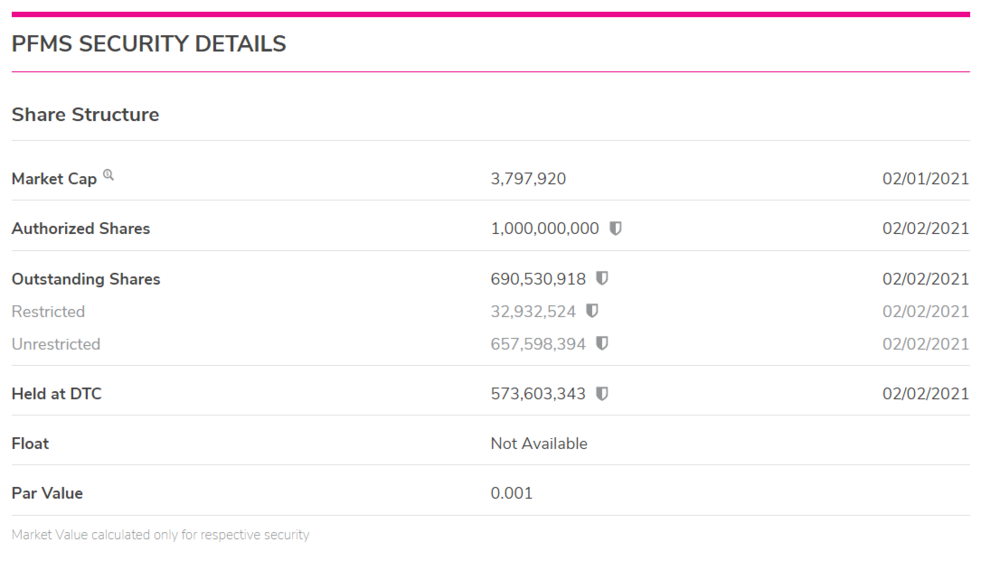

PFMS is popping

-

Penny stock thread split

- Penny stock thread split

Now we are starting to move, .001s falling- Penny stock thread split

The pulse thing is the main part. It's a also a first step, next ones being 8k or court updates. I was hoping for more volume though on that news... thought we at least see .0015 but the ASK is holding on with 150k shares. I added 1M shares today bringing me to 3M total. 2nd largest holding currently behind XMET- Penny stock thread split

- Penny stock thread split

TSNP trying to break the 52 week high in PM, it's gonna buck up if it gets over $0.50 before the sell offs happen.- Penny stock thread split

They're voting on the ABILITY to do so or the ABILITY to increase the Authorized shares on Friday. I believe today is that last day to cast any common share votes... you had to be in for a certain amount of time before the announcement. ALPP twitter posted the below tweet when it was last above $4. That makes me think they'll go with the A/S increase if it stays above that point. Organic uplist means not by means of an R/S. However, if it's in the $3s they have to take in the risk of damaging the uplist process (have to stay above a certain PPS) and will probably R/S 1:2 of 1:3 to protect the PPS requirements. So Short will probably try like hell the next few days to put her under $4- Penny stock thread split

Lots of indicators like a forming Golden Cross, and 1 current unknown market fact from my own DD no insider knowledge. No spilling before I've gotten more shares, honestly I probably shouldn't have said anything but I know I trapped a few of you fine fellows with me back in the summer. Take it for what you will.- Penny stock thread split

I've got a feeling it's going up today and the market doesn't know yet. Bid/Ask at .0008/.0009 I'm trying to buy another 1M at open, don't screw it up for me lol- Penny stock thread split

Who here is in SNVP?- Penny stock thread split

In a vacuum yes value is preserved, and I've held through a few Reverse Splits for that reason, but trading is also about sentiment of the shareholders. Flippers and shorts love R/S, offerings, dilution anything that can spook the mob. People who have smaller common holdings HATE R/S because it kneecaps their future profits so they often bail. I'm still holding a $2.5k bag of BRRN formerly QUTR at 50% my investment value where everyone else bolted while I held through. Put it more at the current PPS If you hold 1000 shares at $4 in a 1:2 R/S then it become 500 at $8, but then a bunch of people sell at $8, shorts start putting downward pressure, and the PPS falls and if you haven't sold it becomes 400 at $4 and you are out the difference. The reason I voted for the A/S increase is that they've been incredibly judicious on dilution, only doing so to acquire new businesses that have increased shareholder value (QCA, Impossible Aerospace, and Vayu were all acquired by that manner). That way when we're at $20 I have that number times my current share number not half or 1/3 The original ALPP run in November 2019 was murdered by the mention of a R/S (not that I'm complaining because it allowed me to get on) Also it typically benefits insiders while wiping out common share holders. That's not the case here, but not everyone realizes that. I'm trying to refer as many people as I can to the unprecedented step that CEO Kent took by making all share types subject to any R/S action.- Penny stock thread split

PFMS SS updated as of today (they're keeping it updated everyday which is a good sign that things are progressing with the merger partner). For a pink it's pretty good, to give you an idea, this is the range that we're HOPING XMET is reduced to. The way they've continually been retiring shares was the catalyst from trips to a penny (which is where I got on board) and then the value potential of the company became clear and it went from a penny to $0.39 in a week or two. When they get into discussions about uplisting is when you have to worry about an R/S, so hopefully by then they're high enough in PPS that they wouldn't need to like we're hoping for with ALPP. I'm bummed there hasn't been a FPVD / Bigtoken 8k yet... maybe they filed it and it will come out tomorrow. I'm so spoiled on ALPP's precision on either delivering early or on time- Surly #Stonks

Surly needs to be a HumblPay only place when that becomes live in the US - Penny stock thread split

Football ...

Basketball ...

Baseball ...

Other Sports ...

Futbol ...

🤫995🤫 ...

Gambling ...

Movies & TV ...

Music ...

Hobbies ...

Lulz ...

Food & Travel

...

Daily Texan ...

Business & Markets ...

Cloak Room ...

Help ...

For Sale ...

Board Discussion ...

Advertise...

Tailgate Donations

Back to top