Football ...

Basketball ...

Baseball ...

Other Sports ...

Futbol ...

🤫995🤫 ...

Gambling ...

Movies & TV ...

Music ...

Hobbies ...

Lulz ...

Food & Travel

...

Daily Texan ...

Business & Markets ...

Cloak Room ...

Help ...

For Sale ...

Board Discussion ...

Advertise...

Tailgate Donations

-

Posts

1447 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Everything posted by RCRanger03

-

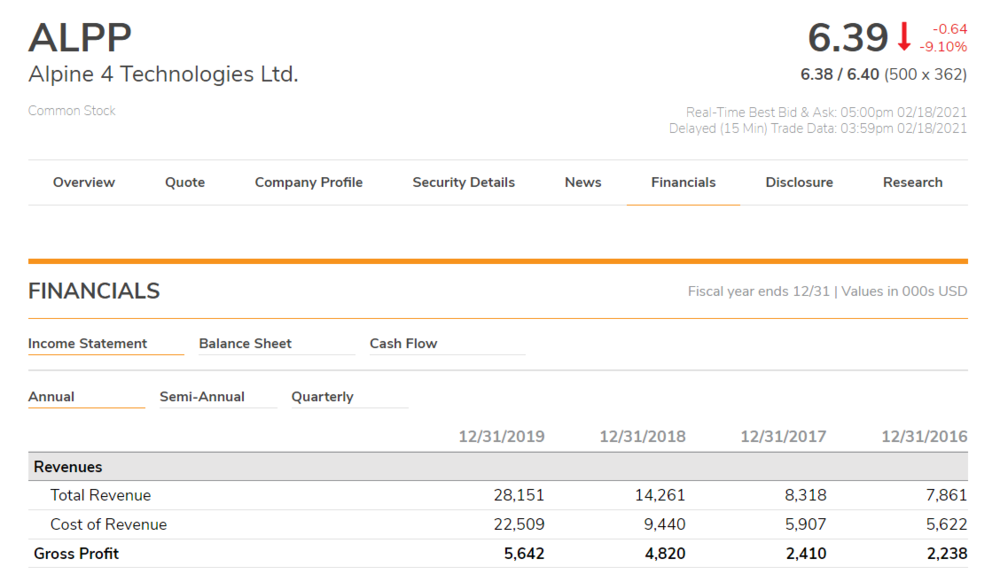

I don't expect any ALPP acquisitions prior to uplisting, but seeing their new A4 Defense Systems category on the website makes so much sense that the companies they mentioned that they've been DDing would be in that sector next. Sent from my SM-G970U using Tapatalk

-

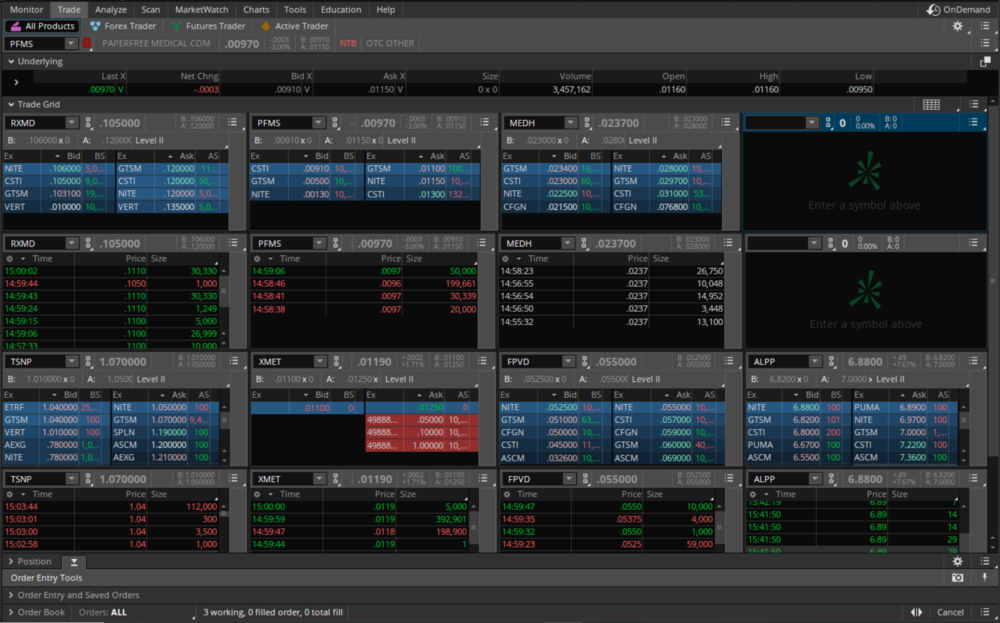

Share Structure (SS) is very indicative of how a stock will trade on the news/catalysts that it receives. The larger the O/S the harder it is to move so you need bomb ass news (like TSNP/HUMBL) it's also why I and others have always believed that the O/S of XMET is so much smaller than 8.4 B even before the court dates. It moves too easily on "low volume". The larger the A/S the more they're able to dilute the shares that you own (lots of people ran for the hills when FPVD when 1 Trillion shares were authorized) I stayed because I was on free shares and it didn't make sense. The price has gone up exponentially since because they weren't issuing any shares in public, and has plummeted when it became clear that they'd issued Billions to Red Diamond. Float is worth knowing because you can predict things like dilution by watching the volume traded, but especially because things can become float locked meaning that instead of trading back and forth the shares owned are held in accounts so anyone wanting in continually has to make it worth someone to sell driving up the PPS in the process. ALPP got float locked a few times because of how few shares were out there.

-

A/S is shares they're authorized to issue - RXMD has 1B O/S is shares that have been issued - RXMD has 485,768,076 Float is shares that are currently available for trading (O/S minus restricted shares) - RXMD has 409,098,903 RXMD has very good SS for a stonk. ALPP had a much better (for share holders) SS that even with the dilution that we agreed to on the latest vote, it's still amazing. TSNP has run to it's current spot from trip 000s on over 4B A/S and 3.5B O/S . Speaking of TSNP, I got exactly what I wanted today if we were going to reject at 1.25 resistance. We held $1 ground and even gained some green. Until news, accumulation is the best possible thing.

-

I feels you bro. Not anxious or worried about ALPP. RXMD - Would like a little accumulation now that we've run a bit, Multiday runs can go back down just as fast unless we build congestion behind us

-

Intraday profit taking beginning to occur before lunch lull

-

RXMD gaining some juice, already at the 2x 20 day volume avg and 5x the 50day As I said last week I don't see why this wouldn't settle $0.20+ on revs alone much less future expectations. I'm just sad I got in a few days later, would have had 2x or 3x share size

-

Keep getting interrupted at work, don't they know that I'm secretly posting about stocks that I'm secretly watching and secretly making many times my annual salary. GEEZ! Somebody is working Level 2 ASK on TSNP Hard = Level 2 data shows the bid (buying price) and ask (selling price). Market makers (those who are buying and selling most of the orders you and I put in and then buying and selling them to other people) can raise or lower these to create or stop runs/dips. Might be clearing the runway for some Friday Scalps or shorts exiting(unclear so far which one more) = TSNP had a run on Friday so people who want to scalp (sell for small to medium percentage gains instead of bearing the risk of long holds), or people who were shorting (betting on the stock to continue down having to cut losses) but they're chopping down anything between 1.11 and 1.20. I'd expect a gap up to resistance and will either reject or confirm. = MM putting up a price on ask and it immediately getting bought, putting one higher and it happening again. When done before the market is open to retail, in ask this can cause the price to shoot up right away, on bid it can cause an opening dip. That may have no correlation to the actual movement. It's sometimes done so people can exit a position. If it can break through probably a very green candle until 1.30s if reject all I'm looking for is to keep it above $1 all day today (of which I'm pretty confident, but then again I didn't think we'd see under $1 again much less $0.70s) = Candles are how many people view stock charting. The body of the candle represents the majority of the trades the "wick" shows peaks and troughs. Resistance is mental (hitting benchmarks like .01, $1 etc) people love setting sells on these because they feel like they achieved something or because they fear something happening when it drops below. Resistance in volume means areas where lots of people have entry on previous action. This is particularly helpful on a stock recovering after a dip like TSNP is, because you can see where people are buying or getting out. The gaps between can explain runs or dips. Hope that was helpful!

-

People have some damn money to spend today. Just saw a $50k dollar value buy on ASK in RXMD at .136

-

Looks like dead cat confirmed. Damn was really hoping I'd get back to 7 or 8 to sell, I might just forget I own these shares.

-

Here comes the dip on PFMS...

-

Oh hell yes JANE is buying on ALPP! They're officially recognized as a Lead Market Maker, they don't play stupid games like NITE https://www.janestreet.com/ EDIT: What the hell they're showing up on TSNP too?! Buying spree!

-

Yup, that's called time and sales which shows the orders being completed. Now seeing many even more massive orders. $100k plus dollar value

-

Lol, the only other sure thing about ALPP is dipping on good news lol expecting that too! TSNP gapping to $1.20 like I thought, break through you son of a gun EDIT: Oh damn look at that, okay

-

Not Uplist yet, but told you they love their 30mins before open news. Love it!

-

RXMD hitting the reddits. Arc1 who posted is very legit, is who put me onto ALPP in the first place and had been already been accumulating for a while when I got in. I believe he's holding around 1M shares there still. He's no joke on evals, I take this as a very good sign - https://www.reddit.com/r/pennystocks/comments/lpno75/rxmd_progressive_care_otcqb_40_million_revenue/

-

Somebody is working the Level 2 ASK on TSNP hard. Might be clearing the runway for some Friday scalps or shorts exiting (unclear so far which one more), but they're chopping down anything between 1.11 and 1.20. I'd expect a gap up to resistance and will either reject or confirm. If it can break through probably a very green candle until 1.30s if reject all I'm looking for is to keep it above $1 all day today (of which I'm pretty confident, but then again I didn't think we'd see under $1 again much less $0.70s)

-

LOL I've only been chopping positions for so long now, I forgot I'm in a new one. RXMD - Updating all of their SEC filings would be my next expected news, they just got their OTCQB ducks in a row in Feb. Biggest catalyst would be an update on the S-1 they've preliminarily filed which is uplist, but those tend to take forever. ALPP S1 was filed in Feb 2020, amended in July 2020 (likely due to commentary) and then uplist announcement came right before the end of the year. RXMD filed S1 in November 2020 . So hoping for an update in March or April On revs alone it should be more like .20 - .40 so definitely undervalued right now, still would like to see it break through previous high like I did forever with ALPP. The big open questions that I have is how they're intending to get the PPS up for NASDAQ aspirations that wouldn't involve at least a small R/S. This was an open question for ALPP too, and they solved it by acquiring companies. My guess RXMD would do that through partnerships like the MyVax deal.

-

TSNP - nice bouncy start to PM T Trades. Lots of stonky twitter chatter about connections via digibyte to Microsoft Azure. Needs to break congestion at 1.20 - 1.25 to go back up. ALPP - I have a hangover from last week not uplisting, would be nice if they just started off the week with a PR. They tend to autopost on twitter around 30 mins before market open. Also now that they have 50M don't be surprised if they pair uplist with another acquisition to grab attention of some big fish. XMET - Strong support developed at .01, lots of new penny investors feeling like they got in on the ground floor. Fine by me. FPVD - We'll see if the recovery after the dump was a dead cat bounce or consolidation in the .05s, rejected twice at .065, so that's what we're looking to see break through. PFMS - Needs more news to do anything substantial, like I posted last week if the bottom falls out there will be a bounce of .007 and then we'll see if people are watching to load. I'm not moving any shares till we hear from Sam Goh.

-

ThinkOrSwim on the Charts tab, with some of my favorite indicators added in. I'm learning Volume Profile (the barchart on the right) to get a better sense of gapping up and down as opposed to my gut instincts which are often disappointing (I'm looking at you right now FPVD). Arrows are MSpaint lol This is the view I have on in the background on my computer during work. Need to fill my 8th spot!

-

EDIT: false alarm I added an extra 0 in my mind, lot of buying on the ask in to the close.

-

PFMS outlook using Volume profile, we're sitting on top of a lot of support, but looks like if .009 breaks downward there's a lot of stopping power at .007 -. 0075, below that is freefall. Likewise however if we could get a little juice its gappable up to .015 which is why we see it flash upward any time there is buying. .016 clears and we should see a nice gap up and hopefully create some new congestions on the way to support it.

-

Don't need to be sorry, just being honest with people. It's a bit of a dangerous game to come to call outs late. Sometimes that works out, sometimes you get stuck at the top when momentum dies out. Happened to me lots of times. I try to put people onto plays pre catalyst/run. You options are: - Cut bait and take the loss, rebuy if you think you can get see a good dip and you still like the play's outcome. - Average down by buying shares at this lower price. Definitely adds more risk and sometimes it keeps going down you can get stuck with a heavy bag thats hard to offload, but it makes exiting or getting on free shares on a future leg up much easier.

-

I mean other than being up over 100% from when most people got in .004 - .005 If yall don't want to wait for catalysts R/M plays aren't for you, or take out your investment and let free shares ride. These things only move on specific news, not great for scalping. The reason and risk/reward for getting into PFMS is if you think Samtrade is going to move in without a R/S. If they do you're going to make good money, if they R/S or back out it's going back into the low .00s

-

Friday and I'm big Green on trading? The unprecedented effects of climate change are real!

-

The arrow was a nice touch. Now compare that to ALPP. They actual did better in 2020 than ALPP did (COVID hurt ALPPs contracts, whereas it helped RXMD)

Football ... Basketball ... Baseball ... Other Sports ... Futbol ... 🤫995🤫 ... Gambling ... Movies & TV ... Music ... Hobbies ... Lulz ... Food & Travel ... Daily Texan ... Business and Markets ... Cloak Room ... Help ... For Sale ... Board Discussion ... Subscribe!... Donate!... COOKIE MONSTER!